BuildingMinds’ Expansion into CRREM Version 2

CRREM Version 2 is live on the BuildingMinds platform

The Carbon Risk Real Estate Monitor (CRREM) established targets for carbon emissions in real estate to align with the Paris Agreement, making it a vital instrument in real estate sustainability. Its released pathways translate these goals into region-specific benchmarks, helping real estate managers measure against 1.5°C and 2°C warming limits. It enables benchmarking against these trajectories to identify and price risks related to low-efficient buildings. Aligned with international frameworks and supported by industry leaders, CRREM assesses properties' readiness for the 1.5°C goal, enabling stakeholders to identify improvement strategies1.

It pushes those who follow the CRREM pathways faster toward redefining how to perceive and measure sustainability in real estate. This version boasts several key updates designed to improve our approach to carbon and energy targets. BuildingMinds is unique in its ability to use the CRREM 2 pathways with or without retrofit planning scenarios directly.

The new CRREM pathway

Markets began to respond following the launch of CRREM version 1 in 2019 when the group introduced decarbonization target pathways covering the most important global real estate markets and aligning with 1.5°C and 2°C global warming goals until 2050. CRREM aims to estimate risks associated with buildings’ carbon emissions and develop methods to measure impacts on investor portfolios under different scenarios. The CRREM framework enables the assessment of the impact retrofitting an asset can have on a portfolio’s overall carbon risk.

The BuildingMinds platform for the new CRREM pathway

The BuildingMinds platform enables long-term stranding risk prediction by analyzing the development of building performance in relation to the established CRREM carbon and energy targets. Users can easily track in a visual way how the projected future performance of individual buildings compares to their specific CRREM targets that get more and more ambitious towards 2050.

Share of stranded assets

BuildingMinds CRREM analytics helps users identify potential stranded assets within their real estate portfolios, in line with the 1.5°C or 2°C carbon and energy targets. By analyzing data on a granular level, the platform provides insights into the share of stranded assets and offers breakdowns by individual buildings, sites, regions, and countries.

What’s New in CRREM Version 2

Carbon Compensation Constraints:

Regarding the assessment of a building’s carbon performance, Version 2 comes with slightly changed rules by restricting overcompensation of emissions from different energy sources. It is still possible to compensate for emissions from electricity procured from the grid by feeding self-generated PV electricity into the grid. But in case a building exports more electricity to the grid than it takes (net negative electricity balance), this does not result in “negative emissions” that could be used to compensate for emissions related to the combustion of fossil fuels or district heating (no over-compensation).

CRREM V2 provides a major update reflecting the latest climatological scientific knowledge, the actual progress of decarbonization as well as some methodological improvements, including new emission factors that are aligned with the methodology of the Science-based Targets Initiative (SBTi).

This version pushes the real estate sector to strengthen its efforts to be on track toward achieving the climate targets of the Paris Agreement. Latest climatology research shows a lower remaining carbon emission budget to limit global warming to 1.5°C above pre-industrial levels, resulting in steeper decarbonization pathways also for buildings. On the other hand, the updated methodology of CRREM Version 2 assumes a much faster decarbonization of energy grids (net-zero by 2040 in many cases), therefore penalizing on-site fossil fuels for heating while fostering the switch to “all-electric” buildings. The calculation of the CRREM pathways is based on specific assumptions which have been updated or slightly modified in the latest version. Besides the assumed global growth of building area, there are some noteworthy changes of these assumptions and the overall methodology:

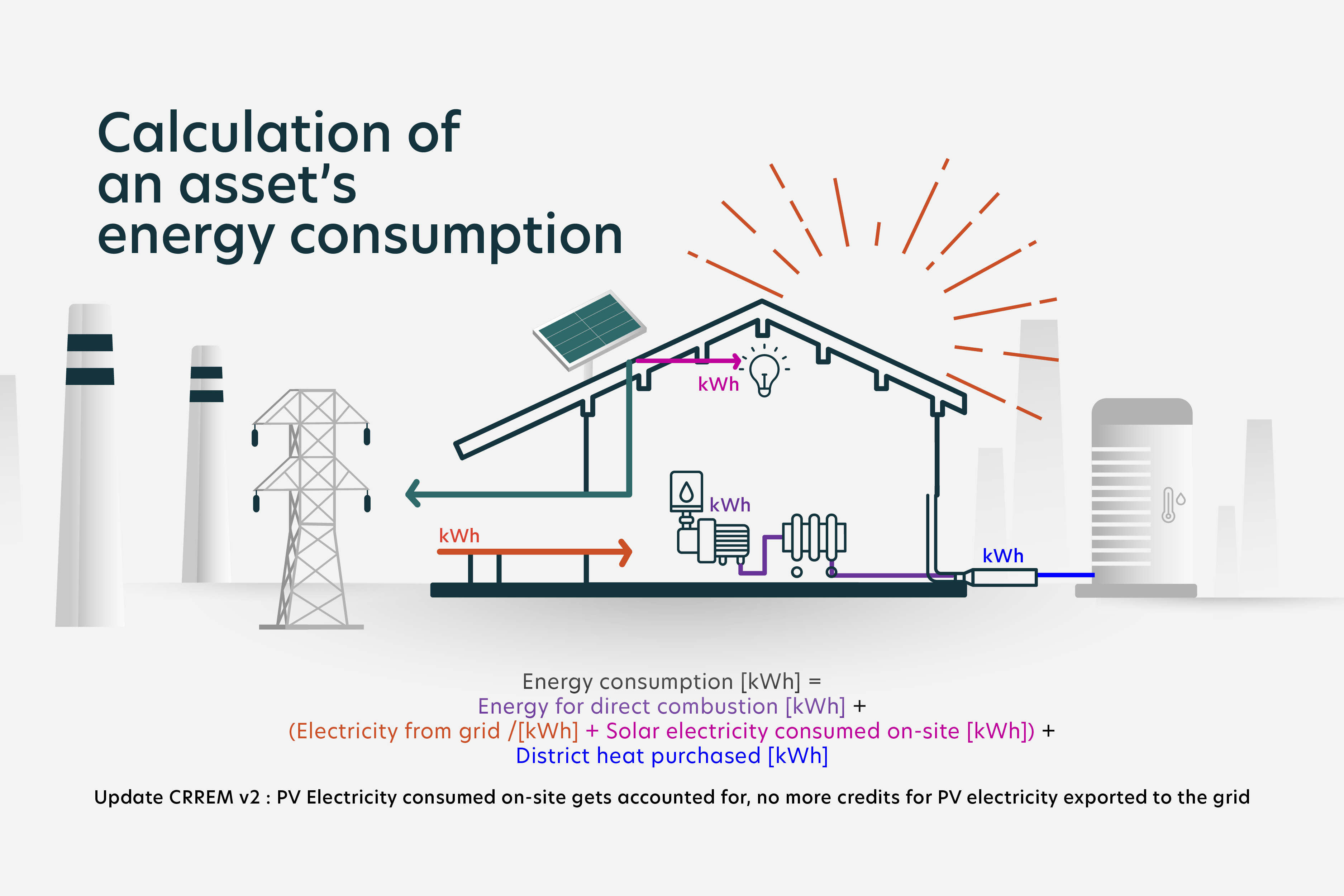

Energy Consumption vs. Net Energy Demand:

Besides the decarbonization targets in terms of carbon intensity: kgCO2e/ (m2*year), the CRREM framework also provides energy intensity targets: kWh/(m2*year). Unlike Version 1's Net Energy Demand (NED) approach, Version 2 focuses on a building’s energy consumption, irrespective of its source. This approach ensures an evaluation of a property's energy footprint following the principle of “efficiency first”. The energy consumption approach of Version 2 now also accounts for the electricity generated with solar PV panels and consumed on-site while not considering any compensation for electricity fed into the grid (see the above infographic).

Updated Sustainability Targets:

CRREM Version2 comes with a comprehensive update of all pathway starting values. The more restrictive remaining carbon budget, another type of emission factors and the shift to an energy consumption-based approach has resulted in a general shift of the pathways that better meet the requirements of real estate owners.

Revised Emission Factors:

In order to align the CRREM approach with the methodology of SBTi, PCAF and other standards, Version 2 refers to another type of emission factors that are used to calculate carbon emissions related to energy consumption. The new methodology excludes transmission and distribution (T&D) losses, but only considers the energy (electricity and heat) generation within a country. This refinement ensures a more precise assessment of a property's environmental impact since T&D losses are now allocated to the energy instead of the building sector. It is important to point out that for this reason one should not simply compare CRREM pathways of versions 1 and 2 and then conclude that the requirements are generally higher in Version 2, as the performance of a building is calculated based on different emission factors depending on the version (these are generally lower for Version 2).

New Building Typologies:

The building type ‘distribution warehouse’ now encompasses two sub-types with distinct pathways: warm (non-conditioned) and cold (air-conditioned) warehouse. This reflects the typically higher energy and carbon intensity of cold warehouses due to their intrinsic energy requirements and the increased emission of refrigerants (F-gases, see below).

Separate pathways with and without refrigerants / F-gases:

CRREM encourages building owners to collect data on the emissions of refrigerants such as F-gases that are typically used for cooling purposes (in air-conditioning systems and refrigeration systems especially in the retail sector). These refrigerant chemicals (“fugitive emissions”) typically have a significantly higher impact on global warming than CO2. CRREM Version 1 only came with one decarbonization pathway per country and property type that included fugitive emissions of refrigerants. Since many real estate stakeholders do not know the amount of these non-energy related emissions, the results of a CRREM analysis could be misleading (bias toward better results). CRREM Version 2 has two distinct pathways, one excluding and one that includes refrigerants.

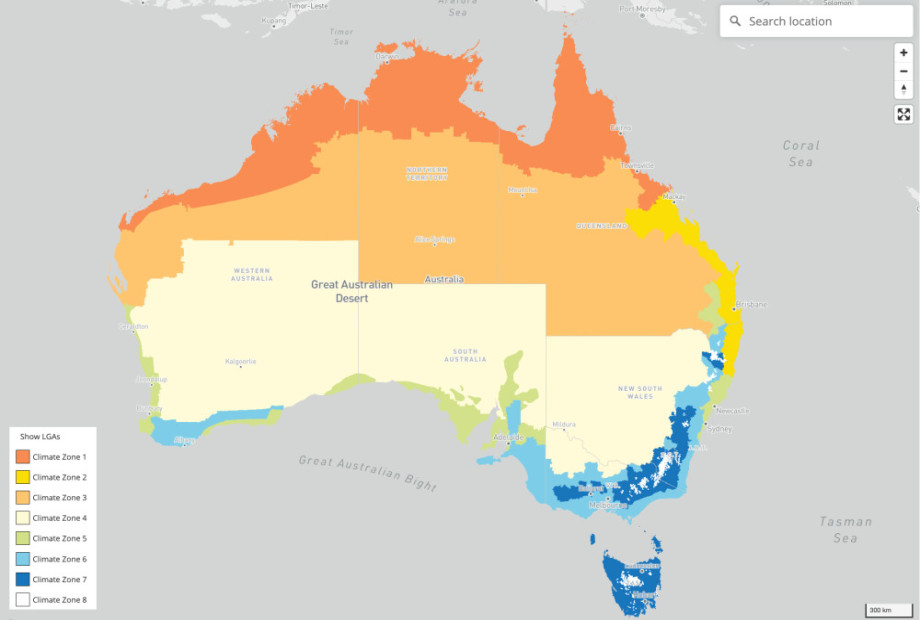

Climate Zone Map2

Regional Granularity: CRREM V2 introduces sub-regional pathways for Australia and additional US cities, providing insights into diverse climate zones and emission factors. This enhancement significantly refines the accuracy of the CRREM framework in these regions3.

Australian climate zones are differentiated in CRREM Version 2

Climate zone 1

high humidity summer, warm winter

Climate zone 2

warm humid summer, mild winter

Climate zone 3

hot dry summer, warm winter

Climate zone 4

hot dry summer, cool winter

Climate zone 5

warm temperate

Climate zone 6

mild temperate

Climate zone 7

cool temperate

Climate zone 8

alpine

Impact and Significance

The integration of CRREM Version 2 into the BuildingMinds platform includes core stranding risk analytics but also extends to our carbon pricing module (pricing of CRREM excess emissions and calculation of Carbon Value at Risk, CVaR) as well as our retrofit module, empowering stakeholders with actionable insights and tangible data for informed decision-making in real estate ventures. Performing stranding risk analytics with BuildingMinds and CRREM Version 2 signifies a big step toward realigning real estate practices with emission budgets and the Paris Agreement's stringent targets, making it a valuable tool for stakeholders.

Jens is leading efforts to drive the real estate industry toward greater energy efficiency and decarbonization.

"Before I joined BuildingMinds, I was the head of the CRREM project that aimed to measure the risk of inefficient buildings with high emissions. I started the project just after getting my PhD. Our objective was to provide the real estate industry with transparent and long-term decarbonization targets aligned with the Paris Agreement’s aim to limit global warming to 1.5°C. Unlike other initiatives, we prioritized a scientific approach, to determine the real estate sector’s emission budgets. The result was a set of decarbonization targets, specific for each country and building type. This approach has become an industry standard when it comes to long-term target setting, and risk assessment and is fully integrated into our BuildingMinds platform.”

Dr. Jens Hirsch,

Chief Scientific Officer at BuildingMinds and Chairman of the CRREM Global Scientific and Investor Committee.

About BuildingMinds

BuildingMinds enables owners and managers of real estate to de-risk and drive the performance of their portfolios, clear regulatory hurdles, and protect asset valuations across day-today operations. Its technology platform helps the world’s largest real asset holders, including Zurich, Generali, and BASF, to transform real estate from a resource-consuming to a resourcegenerating industry. By leveraging AI to optimize decarbonization strategies, BuildingMinds meets the needs of real estate managers across reporting and ESG through portfolio management and digital building twins, ensuring that organizations adhere to global and local policies and standards, including regulatory changes. was founded in 2019 by Schindler Group to meet the market’s need for more in-depth building data monitoring and management. Since then, BuildingMinds has grown to a team of more than 150 experts with a presence in 8 countries. The company has received over $100M in funding from Schindler and technological support from Microsoft and other partners.