The Impact of Greenwashing in Real Estate

Many of us are familiar with the concept of greenwashing. Unfortunately, some have even encountered it directly and likely gained valuable insights through challenging experiences. In this article, we will stress the importance of understanding greenwashing to avoid potential reputational brand damage, legal consequences, and loss of market share

This misinformation can mislead stakeholders, particularly tenants and investors, about the true environmental impact of real estate assets. As the demand for sustainable real estate grows, transparency and honesty in sustainability become crucial for the real-estate sector to reach carbon neutrality.

A 2021 study by the European Union revealed that nearly half of companies' "green online claims" were exaggerated, deceptive, or false.

According to the U.S. Environmental Protection Agency (EPA), “electricity and heat production” is the top contributor to global greenhouse gas emissions (34%), followed by industry (24%), agriculture (22%), transportation (15%), and buildings (6%).

When it comes to electricity use in buildings, emissions in the real estate sector rise to 16% percent, surpassing transportation to rank fourth. Given its significant carbon emissions, the real estate sector should be more vigilant about greenwashing and the emerging practice of "greenhushing," which entails avoiding disclosure of environmental impacts. Greenhushing is not an option. Setting targets and data transparency are two crucial aspects when it comes to ESG compliancy, as stakeholders face significant challenges in both investment and the adoption of new technology to successfully achieve net-zero goals (Forbes, 2024).

Risks of greenwashing

Greenwashing poses significant risks in the real estate industry:

Reputational Damage: Companies that do greenwashing can easily damage their reputation. Which can lead to a loss of investor confidence, decreased tenant interest, and overall market share decline.

Legal Consequences: Misleading sustainability claims can trigger legal actions, leading companies to face potential fines, lawsuits, and increased scrutiny from regulators.

Loss of Market Share: Stakeholders demand transparency and genuine sustainability efforts. Therefore, non-compliant companies' risk being labeled as 'black sheep' and losing their foothold in the industry.

A fierce regulatory landscape

Avoiding disclosure can no longer be dismissed, given the array of E.U. regulations on ESG reporting. Investors are advised to take this seriously to avoid jeopardizing their reputation and credibility. The European Union has drafted and enforced the following directives:

E.U. Taxonomy (for sustainable activities),

the Alternative Investment Fund Managers Directive (AIFMD).

Markets in Financial Instruments Directive II (MiFID II).

The broader impact of climate change

The World Economic Forum (WEF) has identified climate action failure as a top global risk, highlighting the urgent need for effective climate strategies in all sectors, including real estate.

Investors are prioritizing sustainability in their investment decisions in the real-estate sector. A recent KPMG survey of global real estate investors revealed that only 12% considered sustainability less important than financial returns.

According to Forbes, decarbonization strategies and sustainable finance will be essential for making real-estate a resilient industry. Consequently, investors are accounting for carbon-related risks and opportunities over the long term, aiming to decarbonize their portfolios and favoring lower-carbon businesses as institutional funds increasingly flow into ESG investments.

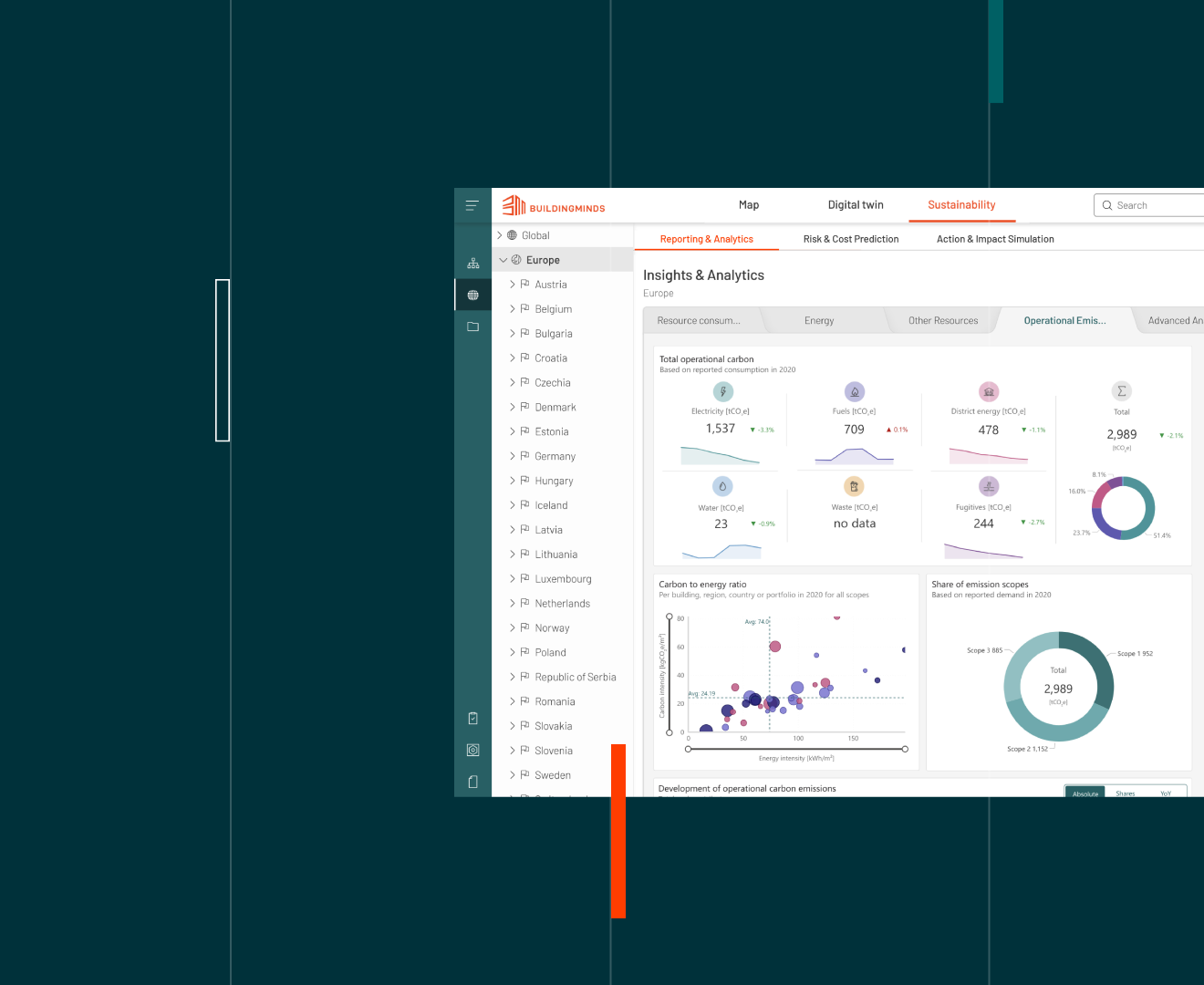

At BuildingMinds, we help our customers steer clear of greenwashing by offering comprehensive support in navigating the intricate ESG regulatory landscape. Our guidance fosters authentic efforts to enhance asset long-term value, minimize stranding risk, and maintain ESG compliance across portfolios.