Risikomanagement

Verstehen Sie die Faktoren, die den Wert Ihres Portfolios steigern oder mindern, indem Sie Markt- und physische Risikobewertungen integrieren. Reduzieren Sie das Risiko von Marktwertverlusten, indem Sie die Berichte unserer Plattform nutzen, die dem Carbon Risk Real Estate Monitor (CRREM) 2.0 folgen und die Vermögenswerte identifizieren, die das höchste Risiko einer Underperformance in Bezug auf finanzielle und physische KPIs aufweisen. Unsere Plattform hilft Ihnen auch, die Wahrscheinlichkeit und die Auswirkungen von physischen Klimarisiken - einschließlich Waldbränden, Sturmfluten, Flussüberschwemmungen, Dürren und mehr - auf Assets zu bewerten und klimabedingte erwartete Verluste zu prognostizieren.

CRREM-Ziele

Das CRREM Rahmenwerk definiert Klima- und Energieminimierungsziele von 1,5°C und 2°C für alle Länder und Gebäudetypen, einschließlich gemischt genutzter Immobilien.

Es prognostiziert automatisch den Energieverbrauch und die CO2-Emissionen bis 2050 für einzelne Gebäude und Portfolios unter Verwendung der offiziellen CRREM-Emissionsfaktoren. Das Rahmenwerk bewertet auch gestrandete Vermögenswerte, bewertet die Auswirkungen von Effizienz- und Sanierungsmaßnahmen auf die CRREM-Performance und vergleicht die kumulierten Emissionen mit dem Emissionsbudget des CRREM-Pfads.

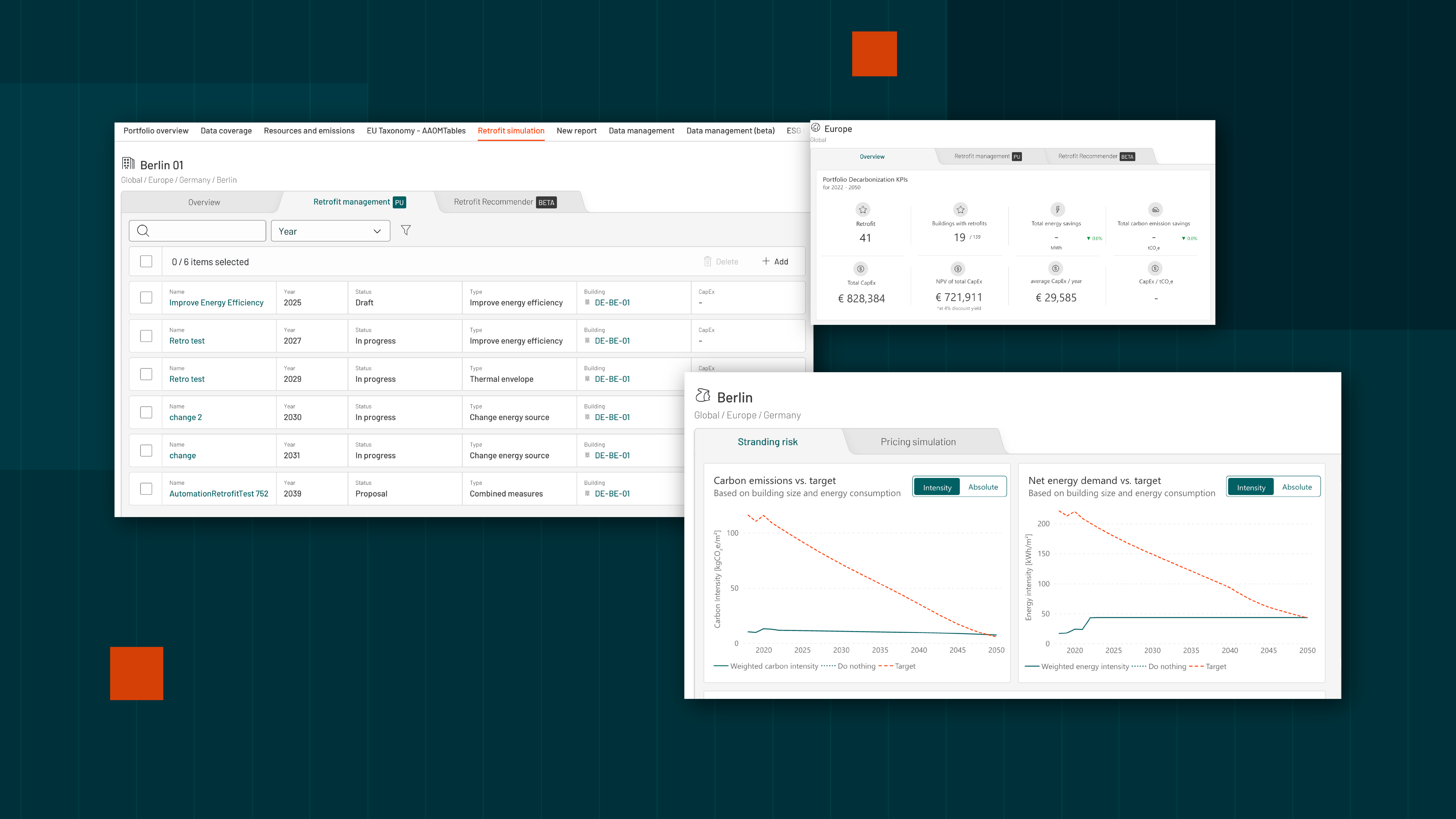

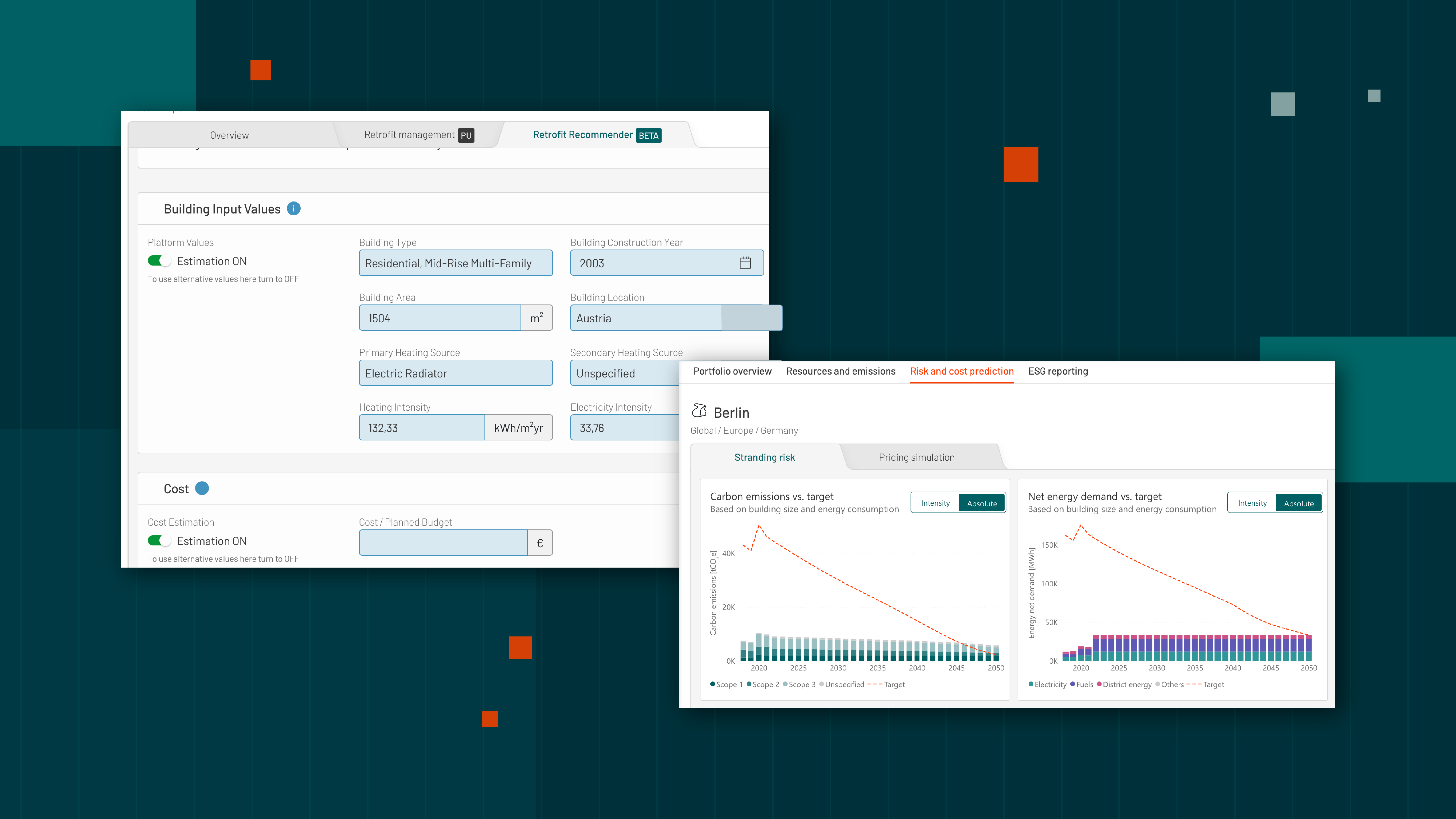

Marktrisiko für Stranding prognostizieren und managen

Schätzen Sie optimale Modernisierungsmaßnahmen auf Basis unseres KI-Modells, das mit Daten von über 1.000 Modernisierungsprojekten aus dem European Green Building Catalogue trainiert wurde.

Schätzen Sie Investitionskosten und Energieeinsparungen für Gebäudesanierungen unter Verwendung von Benchmarks aus der EU-Veröffentlichung von 2019 zu Niedrigstenergiegebäuden. Berücksichtigen Sie Faktoren wie geplante Modernisierungen, Gebäudefläche, Land und Gebäudetyp und nutzen Sie Modernisierungssimulationen, um die Auswirkungen auf die Gebäudeperformance sofort zu bewerten, wichtige Leistungsindikatoren zu evaluieren und Budgets unter Einhaltung von Dekarbonisierungsstandards zu planen.

Bewertung von physischen Risiken

In Zusammenarbeit mit MunichRE ermitteln wir Gefährdungswerte für Risiken wie Hochwasser, Starkregen, Erdbeben, Meeresspiegelanstieg, Hitze, Vulkanausbrüche, Tsunamis, tropische und außertropische Wirbelstürme, Hagel, Tornados, Blitzschlag, Sturmfluten und Waldbrände. Dies ermöglicht es, die aktuellen Risikowerte als Abbild der gegenwärtigen Situation zu verstehen und mögliche zukünftige Veränderungen durch den Klimawandel zu antizipieren.

Die Nachfrage nach datengetriebenen Informationen für das Gebäudemanagement und die Optimierung von Immobilienwertanlagen ist beträchtlich und wächst weiter. Durch die Verbindung von Industriekenntnissen und Digitalisierungs-Know-how kommt BuildingMinds eine wichtige Rolle bei den Veränderungen im Sektor zu.