Event: BuildingMinds inspires new ESG resolutions for 2025

On December 17, 2024, BuildingMinds held its first seminar in France, a debate aimed at real estate asset managers on the topic of improving ESG (Environmental, Social, and Governance) performance. This event provided participants with numerous avenues for reflection and action to enhance their performance in real estate, a sector that currently accounts for more than 10% of France’s GDP (EY, 2023)

Following Rudy Aernoudt, an economist, philosopher, author, columnist, professor at the universities of Ghent and Nancy, the main commentary of Tina Paillet, President of RICS, and Méka Brunel, President of the Palladio Foundation, enlivened the first portion of the roundtable discussion. Joining them were Virginie Wallut, Director of Real Estate Research and Sustainable Investment at La Française Real Estate Managers, Émilie Jaskula, Global Head of Office at AXA IM Alts, and Thierry Laquitaine, SRI Director at AEW.

“There is no doubt that the real estate sector holds the key to achieving Net Zero targets and ensuring that our cities are resilient and sustainable. This also highlighted the opportunity for the industry to come together as a whole, inspiring collaboration and ultimately driving the transformative change we urgently need,” said Tina Paillet, RICS 2024 President, “Thank you to BuildingMinds for organising this seminar which gave RICS members – who are part of a leading global professional body in the built and natural environments – the opportunity to debate the issues our sector is facing and inspire action.”

“These are challenging times for both real estate funds and SRI, but it is crucial to stay committed to our principles while ensuring the active involvement of all stakeholders. To achieve this, it is vital to establish a shared language and align key performance indicators (KPIs) across the entire real estate value chain,” Virginie Wallut said.

Hosts of this seminar, Philippe Boyer, Director of Institutional Relations & Innovation, and Jean-Éric Fournier, Chief Sustainability Officer of Covivio, introduced and concluded the discussions.

The first speaker, Rudy Aernoudt, reminded the audience of asset managers and real estate investors that the EU must invest between 4.4 and 4.7% of its GDP in the ESG (Environment, Social, and Governance) sector to achieve its goals, amounting to a total of 750 to 800 billion euros, with a current shortfall of 300 billion to be filled by private capital.

With the macro-economic challenges of meeting the Paris Climate Accords clearly laid out by Prof. Aernoudt, the round table entitled "Transforming the Real Estate Industry: Sustainable Development and Risk Mitigation Strategy" began. The group of 5 experienced practitioners focused on tested and effective strategies to deliver on ESG targets while also challenging the heavy load regulation and associated measurements create for many who could arguably better invest the time and energies in doing the work of making assets more sustainable.

The discussions emphasized the crucial importance of implementing environmental strategy actions in a sector representing more than 10% of the French GDP – real estate- to ensure that regulatory compliance is not the only priority. Although global emissions from the building sector have seen an average increase of 1% per year since 2015, investments dedicated to energy efficiency have recorded a decrease of 7% between 2022 and 2023. This trend is further reflected via 45% of the participants in the international survey conducted by BuildingMinds, which indicated costs associated with eco-friendly practices and materials are some of the main obstacles to financial and portfolio growth.

In describing the alignment of financial and sustainability perspectives in support of the decarbonization of the real estate sector, Prof. Aernoudt's introductory remarks resonated with many participants. He emphasized: "We have seen that in Belgium, a market facing the same imperatives as France, real estate companies must devote 3% of their turnover to financing their transition. About 60% of these companies have the necessary resources to make this investment, while 20% of them lack the means to make energy improvements or invest in a building management system (BMS). Nevertheless, European banks, particularly French ones, are becoming increasingly demanding, especially with regard to ESG criteria."

Global Problems, Global Solutions

The debates, led by José Pereira, Southern Europe Sales Director at BuildingMinds, highlighted noteworthy examples across Europe and beyond, presenting various innovative solutions to mitigate the risks associated with climate change.

The first example mentioned, concerning the nearly 85% land area within the city of Rotterdam located below sea level, perfectly illustrates how sustainability is inextricably linked to resiliency. The discussion highlighted the construction of floating neighborhoods using reusable and recyclable materials as a safer and more pragmatic solution compared to traditional maritime barriers1.

Another case study focused on the regeneration of the city of Bilbao, Spain, previously highly industrialized. The city renewed its shared land area through a particular increasing green space, which contributed to a 38% reduction in greenhouse gas (GHG) emissions between 2005 and 2018 as mentioned by Tina Paillet.

Finally, Singapore's zero-waste master plan2, a market entirely dependent on the importation of construction materials, was highlighted as an example illustrating how a circular economy can function on a large scale with the appropriate incentives. This plan advocates for the reuse of materials and the incineration of waste.

One of the key topics discussed was the intensification of reporting, highlighting that, although these obligations are necessary, meeting them is often a cumbersome process. Virginie Wallut of La Française Real Estate Managers suggested that the main virtue of this reporting exercise is the awareness of priority issues, leading to the adaptation of actions and the measurement of impact. She clarified that reporting allowed the development of a common language among all with the final aim being to avoid the "dispersion" of actions and impact. As a reminder of just how regulated the building sector truly is, Thierry Laquitaine stressed that in France alone, there are more than 3000 regulations. He underlined that there is a real challenge in accessing resources and maintaining coherence between these regulations, with some texts requiring the collection of rental-unit level energy consumption data and other texts stipulating that tenant data is private and confidential. These sentiments were supported by Méka Brunel, who reminded the audience that we can only control what we can quantify.

These debates were later shared on LinkedIn:

"In a European financial context where banks are lending less and less to businesses, it is up to companies to find new sources of financing," noted Chloé Yoro, ESG Manager at Sogenial Immobilier.

"Beyond the necessary awareness, we must commit to a coherent and ambitious strategy to reduce the carbon footprint of each of our assets. This strategy is also embraced by all our partners, especially hoteliers!" commented Thomas De Clercq, Deputy CEO of the hotel investment company Courbet Heritage. "We have this vision and are implementing an ESG strategy at the level of each of our assets, in the repositioning phase and in the operational phase, as well as at the corporate level."

"The conference synthesized the commitments of many industry players and thus closed the year 2024 in a beautiful way to prepare 2025 under the best guidance," summarized Stéphane Carpier of N'CO Conseil. “Leading companies demonstrated the relevance of integrating energy performance, low-carbon, resilience to climate change and biodiversity into their asset management in order to guarantee the long-term value of their assets, ensure financing from banks and also look for new sources of investment."

About RICS

We are the Royal Institution of Chartered Surveyors (RICS), a leading professional body working in the public interest to advance knowledge, uphold standards, and inspire current and future professionals. Our members help to create and protect built and natural environments that are sustainable, resilient and inclusive for all.

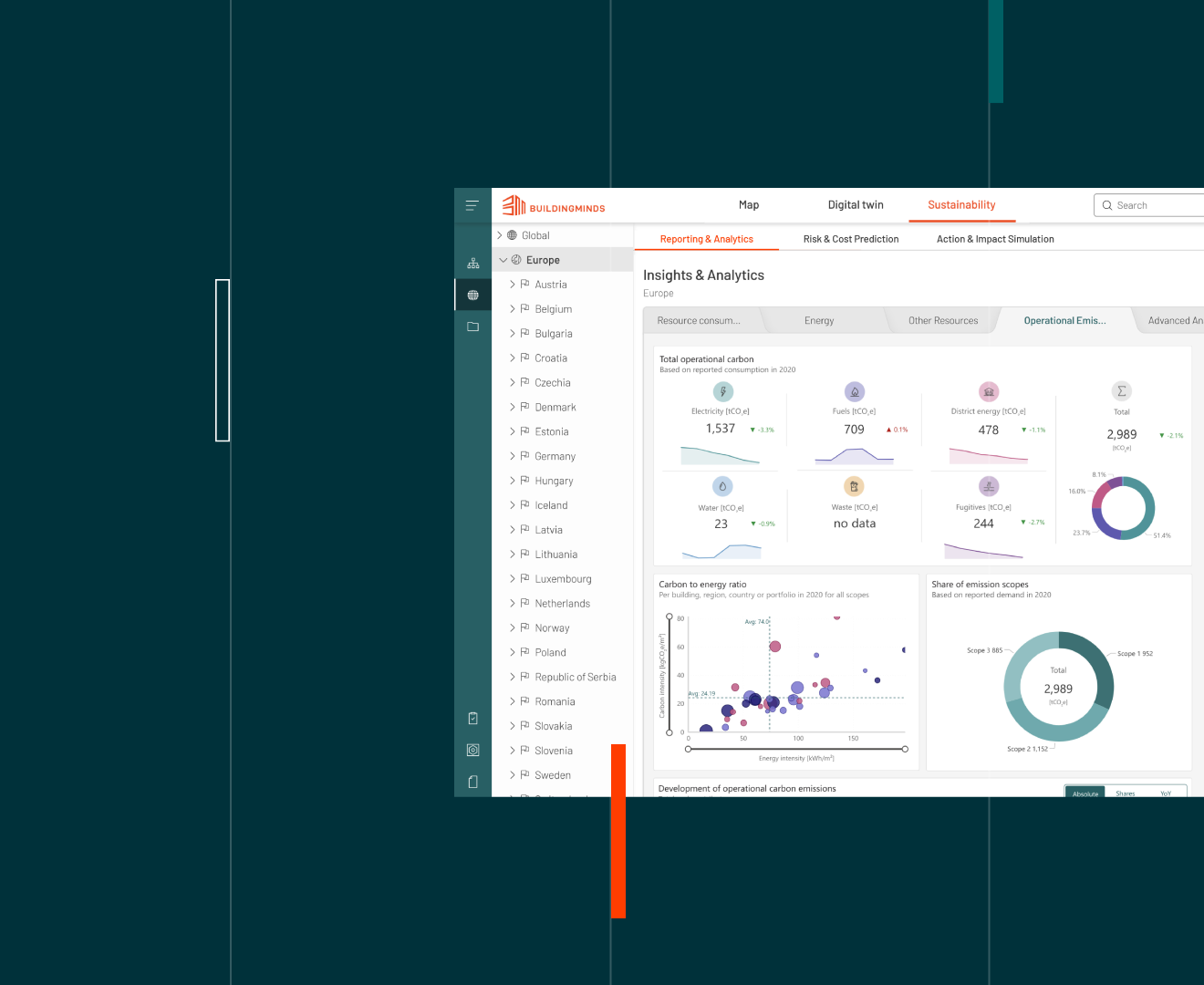

About BuildingMinds

BuildingMinds is a real estate software-as-a-service (SaaS) provider that offers a comprehensive, data-driven platform for optimising building performance and sustainability. Through innovative technology and analytics, BuildingMinds enables real estate owners and managers to monitor, analyse, and optimise their assets, supporting the transition to a more sustainable and data-driven real estate industry.

For more information please contact:

Peter Panayi:

Head of Go-to-Market

BuildingMinds

peter.panayi@buildingminds.com

+44 7929 108 812