Net-zero by 2050: Challenge accepted.

The story of those who are walking the talk

ESG here, sustainability there. Many are talking, but few are acting. The latest IPCC report from April 2022 says it all: emissions are higher than ever before – both for carbon, the main driver of climate change, and for other greenhouse gases. The way to limit global warming is indisputable: we need to halve emissions by 2030 and eliminate them entirely by 2050. But net-zero is a huge challenge. How can we break it down into simple steps? And how can managers create impactful, measurable action plans?

The perfect match - determination and experience

Meet Roger Baumann, COO Global Real Estate & Head Product Development of Zurich Insurance. He is driving Zurich’s net-zero strategy in real estate investment management. With over 20 years of experience in real estate consulting and investment, he is responsible for sustainability, finance and operations, as well as investment product development. As co-innovation partner at BuildingMinds, he works closely with Jens Mueller, Chief Executive Officer, and his team, who is developing a fully integrated data platform for the intelligent decarbonization of building portfolios. Jens has more than 20 years of experience in the IT industry and team leadership – he’s the perfect digitalization counterpart to sustainability driver Roger Baumann.

Value stranding on the way to Paris?

Climate change is leading to increasingly frequent and extreme natural catastrophes, resulting in billions of dollars in losses globally – to the tune of US$280 billion in 2021 alone, according to Munich Re. But even without direct damage from extreme weather events, such physical climate risks can have a negative impact on the value of real estate. Increased risks anticipated by market players – for example, in regions affected by rising sea levels and at higher risk of

flooding – can reduce demand and, thus, the value of local buildings.

Needless to say, government initiatives to reduce carbon emissions also target the real estate industry. At the same time, potential tenants and investors alike are growing increasingly aware of the need for environmentally friendly buildings. Failure to adapt portfolios accordingly may lead to decreased demand, falling rent and sale prices, as well as rising costs due to carbon pricing or even more direct regulatory intervention. These transitory risks have become more and more evident over the last decade. As a result, effective real estate risk management is no longer conceivable today without taking ESG parameters into account.

It’s what you do next that defines your assets

As the EY RE Snapshot 2021 revealed, 90% of the players from the real estate fund industry did not know which criteria a property needs to fulfill in order to be taxonomy-compliant. Yet 43% of investors claim they have a net-zero carbon goal. Another 28% expect to have one within the next 12 months. “Defining where we want to go was the easiest part.” explains Roger. “But the tricky thing is to know where one stands. It may sound trivial, but it’s all about information. It’s about having no doubts about where you stand, from a portfolio or single building perspective.”

"The toughest part comes after the commitment: taking action and measuring the impact."

Roger Baumann

COO Global Real Estate & Head Product Development of Zurich Insurance

Three key areas, one common basis. Zurich, Switzerland’s largest insurer, is committed to using every lever available – investments, operations, products and services – to accelerate the transition to a net-zero emission economy. The action plan is part of Zurich’s ambition to be one of the most responsible and impactful businesses in the world. The measures underscore a commitment made in 2019, when Zurich became the first insurer to sign the Business Ambition for 1.5°C Pledge to limit global warming. “Although this transformation is putting pressure on the markets, there’s much more than that coming out of it,” adds Jens. “In fact, it is opening up countless opportunities for first movers like Zurich Insurance to do good and advance the business.”

Zurich addresses three key areas on the path to decarbonization: reducing emissions across the portfolio, engaging with companies to bring about change, and investing directly in solutions. Measuring and reporting emissions is the starting point of a complex, ongoing journey. A long-term approach is required, one that takes a multitude of factors into account. But there is one thing which all areas need in order to succeed: digitalization.

Tackle complexity or pay the price

“We can’t just refuse to manage the complexity of the resources we need to steer and optimize for the foreseeable future – the next 10, 20, 30 years,” says Jens. “Money, the right skills at the right place and the right time, materials, technology – connecting all these resources is a highly complex task. If you don’t have the data points, it just becomes mission impossible.” Roger agrees: “We have to deal with uncertainty, complexity and different scenarios, all of which make it difficult for a real estate investor to anticipate what’s going to happen with the investment. Technology enables us to remove the uncertainty of actions and their effects. And Excel is just not an option, if you manage large, international portfolios.”

How complex future carbon calculations will become can easily be shown with one simple example. Take an office property in Berlin – market value €6 million, built in 1980, gross floor area 2,000 square meters. With a decarbonization target in line with the 1.5°C climate target, the office building is at risk of falling short of its targets as early as 2024 – with the associated monetary and climate-related consequences. If we assume a decarbonization target of 2.0°C, the asset will not be stranded until 2030. But even in this case, the net present value of the costs generated by the property’s excess emissions would still total almost 1.7% of its market value. The latest research by the Potsdam Institute for Climate Impact Research indicates even higher carbon prices, resulting in a 7% loss of the building’s total market value from 2021 to 2050.“I think we all agree that what’s been officially priced right now at the global level, at the European level, will probably not get the job done,” says Jens. In a high carbon price scenario, major global companies face up to US$283 billion in carbon pricing costs, with 13% of their earnings at risk by 2025. Future carbon prices are creating uncertainty for prediction models.

"Real estate portfolio managers have two options: Try to traditionally predict prices, or adapt to ever-changing, complex scenarios."

Jens Mueller

CEO BuildingMinds

While the ultimate goal of net-zero by 2050 is clear, exactly when and how much is still subject to politics. According to a survey by members of the International Emissions Trading Association (IETA), it could be €63/ton, while other models say it could be €85/ton, and some market analysts even predict a price of €120/ton. Although it may seem like circular reasoning, the best way to keep your exposure to rising carbon prices low is to strictly reduce your emissions.

Performing under pressure: calculate, act, repeat

There are three main areas for reduction: Asset Management, Transaction Management and Development & Construction Management. In Asset Management, Zurich’s focus lies on systematic operational optimization and the conversion of fossil-fuel heating systems to those using renewable energy. Renovations to improve energy efficiency in older properties and optimization measures have already reduced the energy consumption of Zurich’s Swiss real estate investments by over 20% by the end of 2020. In Transaction Management, the due diligence process for new acquisitions includes the analysis of energy, CO2 emissions and other sustainability aspects in an ESG scoring. And in Development & Construction, projects are implemented in accordance with sustainability aspects and national standards. However, it is crucial that the measures taken can be calculated and planned.

In terms of daily business, Roger believes that “We need collaboration and a platform that allows us to run different pricing scenarios, to see what kind of impact they have on carbon costs and valuations. What’s the effect of Capital Expenditures? It’s not only about simulation, it’s also about creating a digital ecosystem.” “A focus on standardization – and by this we mean reporting standards and data standards – is the only way forward,” adds Jens. “Because only digitalized and standardized data is scalable.”

The next big build: digital ecosystems

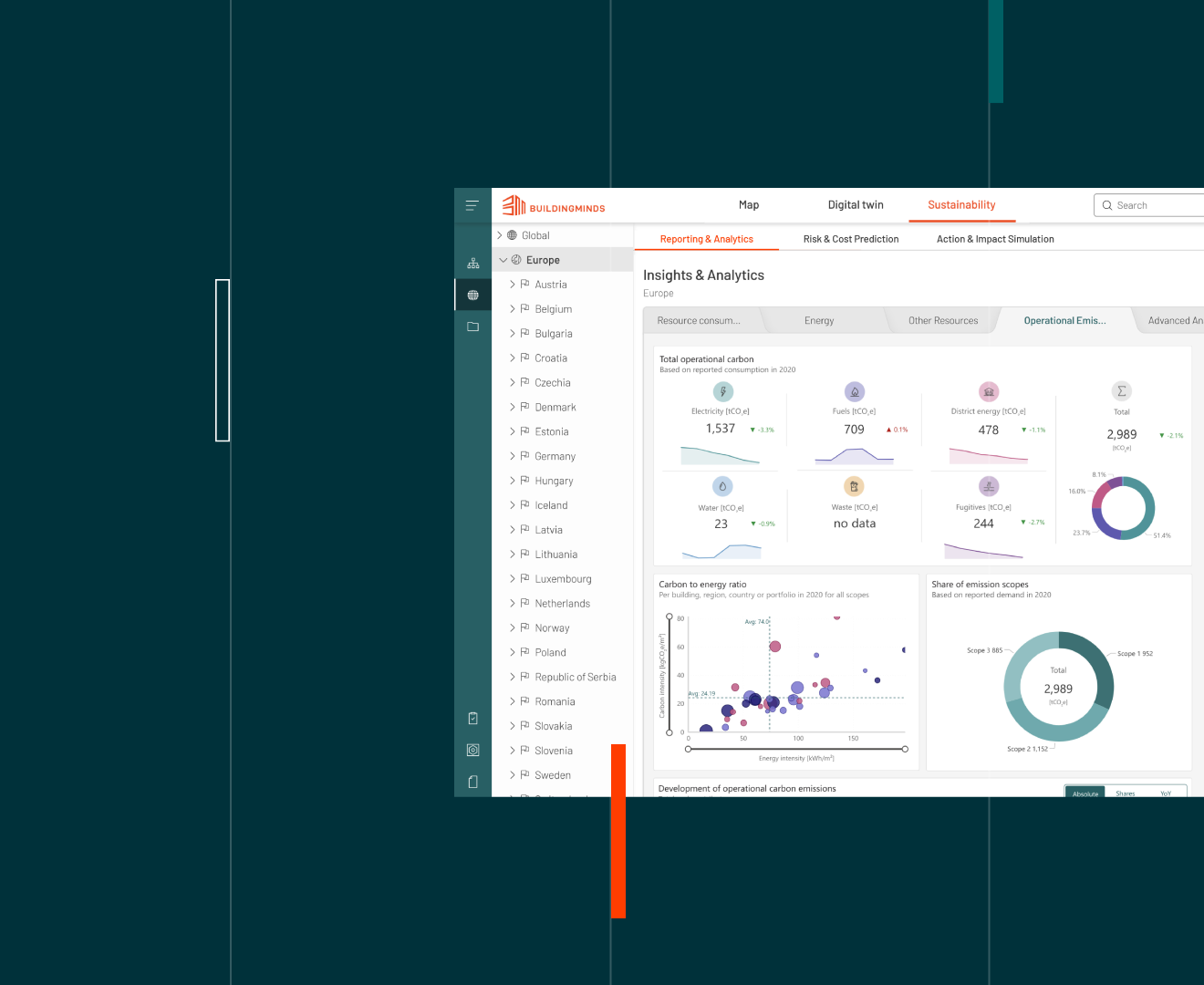

How can you develop a strategy that takes moving variables and unpredictable factors into account? The answer lies in data quality and holistic digital platforms. The key to success is to create a single source of truth for information specific to real estate. In other words, to create digital building twins and unite them on one data platform. “When people hear the term ‘digital building twin,’ most of them think of a 3D building model. But it’s much more than that. At the end of the day, it captures all the workflows and use cases for buildings and portfolios,” says Jens. It plays a key role in the sustainability assessment of buildings, and not only for the operational phase. Portfolios that are diversified regionally and across different use types, different data sources, the interplay between sustainability factors and conflicts of interest within

the organization, granularity of data and long planning horizons – all this demonstrates the need for an integration platform.

"An ESG reporting structure that benefits both internal and external stakeholders will spark a digital transformation"

Roger Baumann

COO Global Real Estate & Head Product Development of Zurich Insurance

“The best platform isn’t worth a dime without qualitative data,” Jens explains. “Data streams don’t mean just any data. Once all the data gaps are closed, which is the first priority, it then becomes a matter of ensuring data quality, which must be done continuously and in terms of consistency, classification, cleansing and validation. Making this effort once today will deliver countless benefits tomorrow.”Integration has to be understood as a two-way street. Dual data flow is only possible with a smart digital platform. This platform will be indispensable for the sustainable management of real estate in the future. The platform will manage the flow of data from buildings, the aggregation and monitoring of this data, as well as the reconciliation and adjustment of target fulfillment and its transfer to operational management, data aggregation, etc.

All information, whether static from ERP systems or dynamic from smart meters, sensors, market or energy flows, is knowledge that can open the door to unexplored areas of opportunity and various use cases. With it, you can benchmark, detect outliers, compare scenarios and, finally, make the best possible business decision. Once you have gathered enough data, you can even become an early adopter of artificial intelligence in real estate.

"We know what we’re up against with net-zero. The only way to tame this beast is through uncompromising transparency and determination."

Roger Baumann

COO Global Real Estate & Head Product Development of Zurich Insurance