Manage risk

Enhance comprehension of appreciation and depreciation factors in your portfolio by integrating market and physical risk evaluations. Reduce market stranding risk through BuildingMinds platform reports, complying with Carbon Risk Real Estate Monitor's (CRREM) 2.0 pathways and pinpointing assets with the greatest underperformance risk linked to financial and physical KPIs. Our platform enables you to gauge the likelihood and consequences of physical climate hazards – such as wildfires, storm surges, river floods, droughts, and more – on assets, while projecting climate-related losses.

CRREM pathways

CRREM framework sets 1.5°C and 2°C carbon and energy reduction targets for all countries and building types, including mixed-use assets.

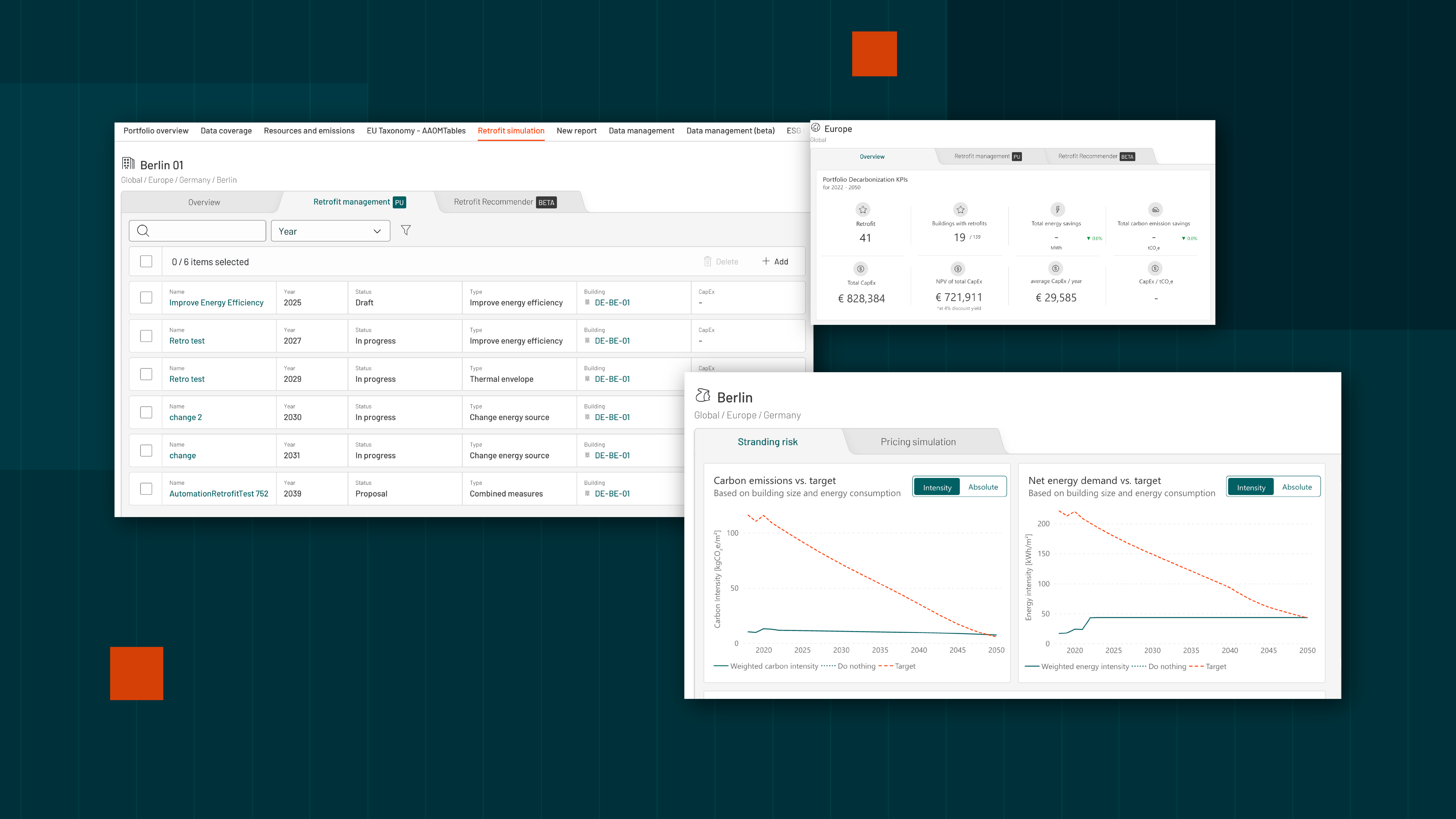

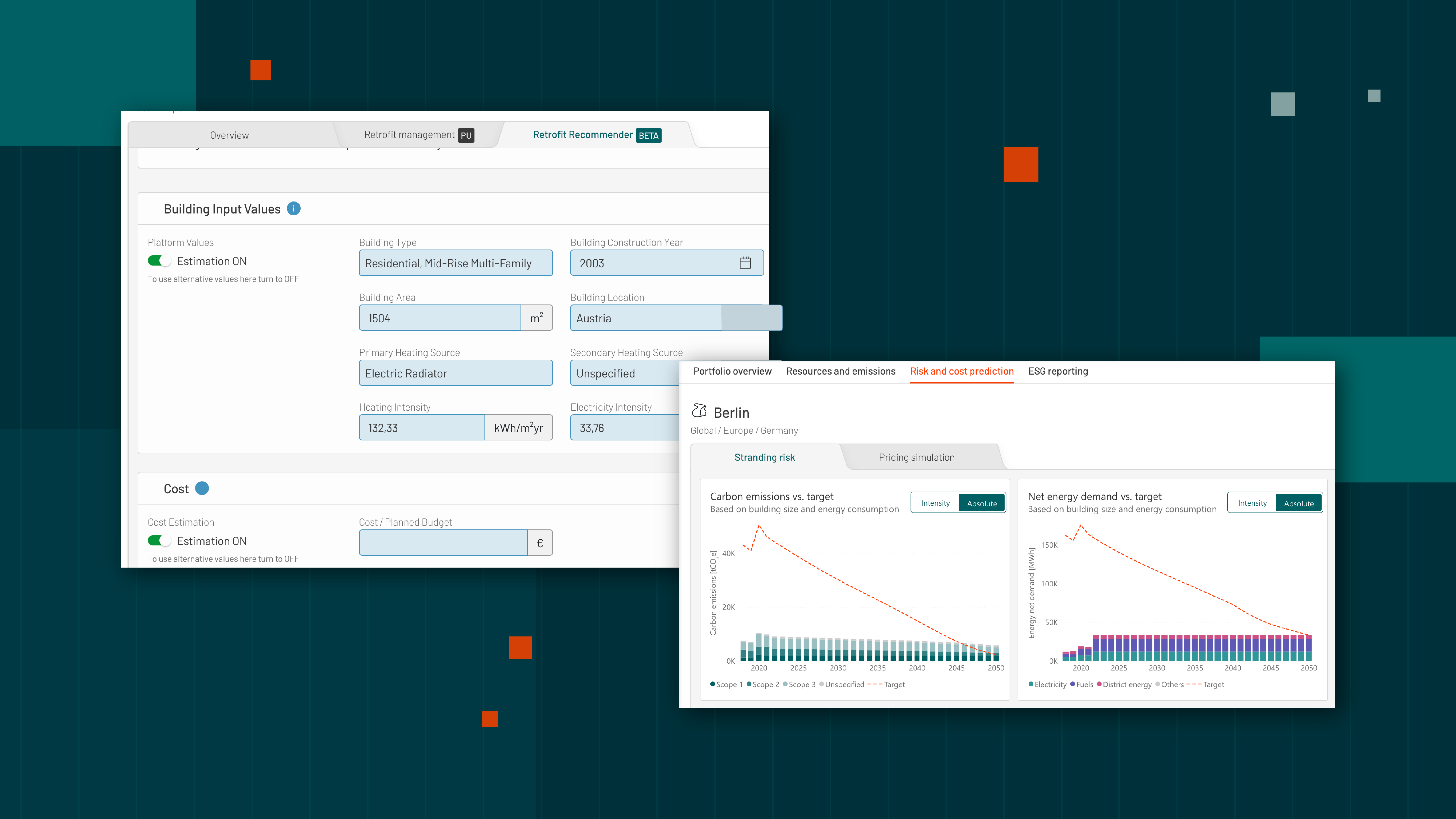

It automatically projects energy consumption and carbon emissions until 2050 for individual buildings and portfolios using official CRREM emission factors. The framework also assesses stranded assets, evaluates the impact of efficiency measures and retrofits on CRREM performance, and compares cumulative emissions to the CRREM pathway's emission budget.

Market stranding risk projections and management

Estimate optimal retrofits based on our machine learning model trained on data from 1,000+ retrofit projects in the European Green Buildings Catalogue.

Estimate investment costs and energy savings for building renovations by using benchmarks from the 2019 EU publication on nearly zero-energy buildings. Consider factors like planned retrofits, building area, country, and building type and use retrofit simulations to instantly assess the impact on building performance, evaluate key KPIs, and plan budgets while adhering to decarbonization standards.

Physical risk assessment

In partnership with MunichRE, we evaluate hazard scores for risks, such as river flooding, flash floods, earthquakes, sea level rise, heat, volcanoes, tsunamis, tropical and extratropical cyclones, hail, tornadoes, lightning, storm surges, and wildfires. This enables you to understand the current risk scores as a reflection of the present situation and anticipate potential changes in the future due to climate change.

Demand for data-driven intelligence in building management and real estate asset optimization is significant – and growing. Combining our industry insights and our digitization expertise enables BuildingMinds to play a role in leading the change taking place in the sector.