Clear regulatory hurdles

Streamline ESG regulatory reporting across international and local reporting frameworks: Optimize your reporting process to comply with global and local frameworks and requirements such as GRESB, SFDR, EU Taxonomy, CDP, CSRD, ISSB, NY Local Law 97, BERDO, and more.

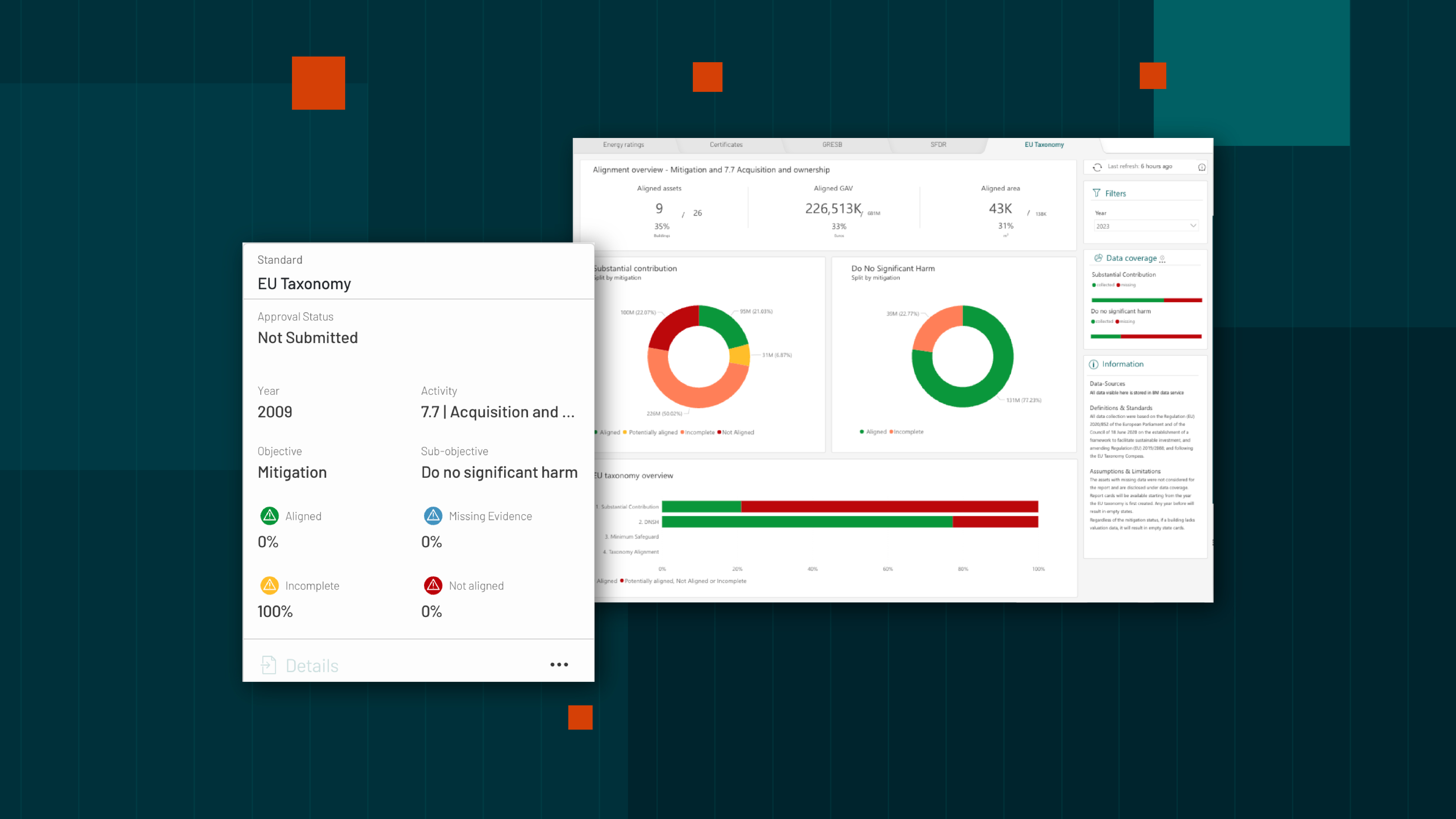

EU Taxonomy

Our EU Taxonomy solution is a simple questionnaire focused on building-level information related to objectives and activities. It covers the real estate section 7.7 (Acquisition and ownership) for climate change mitigation, with sections 7.1 - 7.6 on the roadmap.

GRESB reporting

Submit various certificates, energy ratings, and even EV charging data for each building to ensure precise energy consumption calculations and enjoy seamless asset data submission through API integration.

SFDR Reporting (Article 6,8,9)

Collect and overview data points to report on SFDR to enable reliable data validation for Article 6, 8 and in some cases 9 funds. Our platform also enables reporting coverage across 4 Principal Adverse Impacts (PAIs); mandatory PAIs Energy inefficiency and Fossil fuels exposure as well as two optional PAIs, GHG Emissions and Energy intensity.

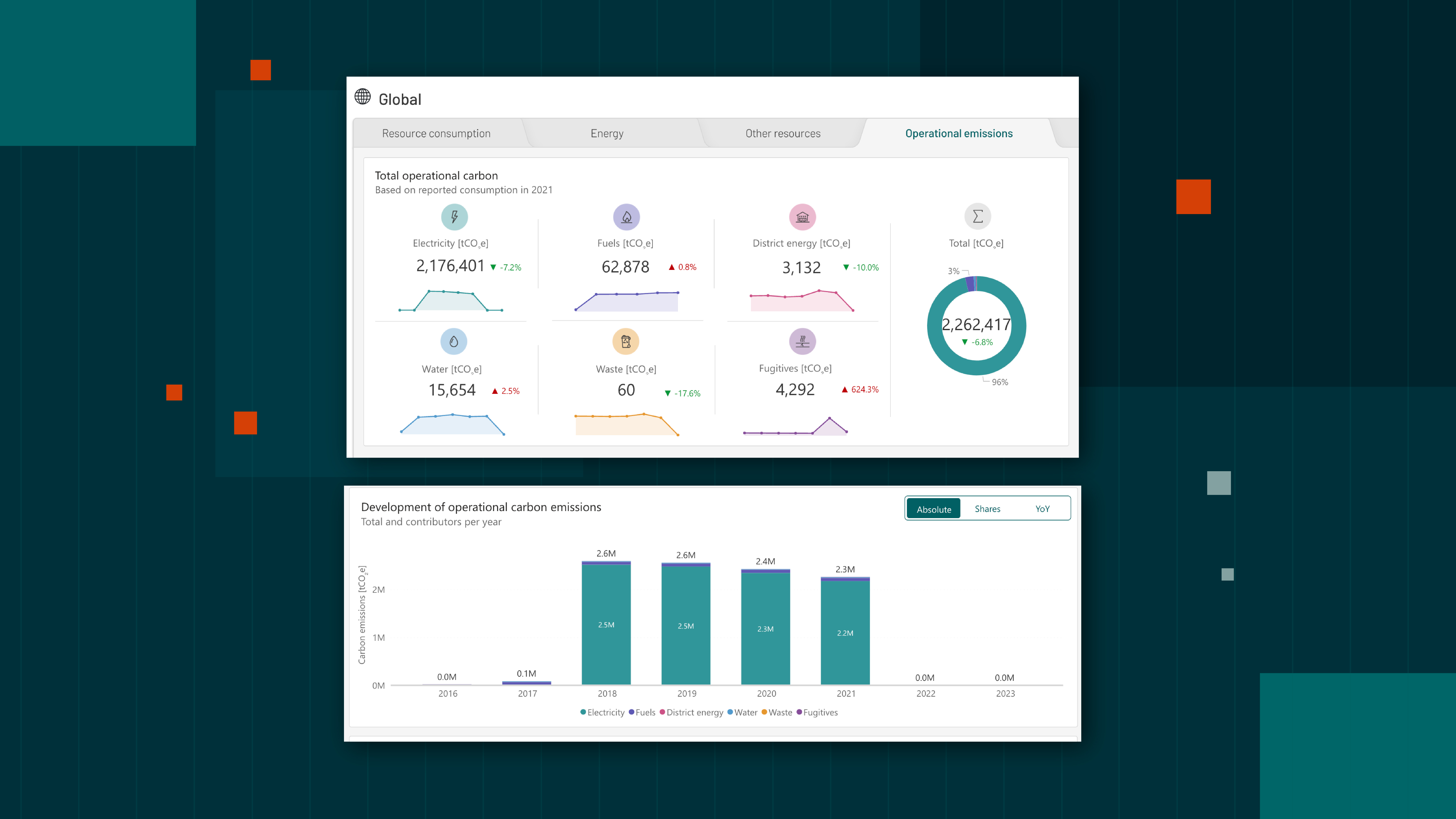

Operational carbon emissions

Automatically calculate your operational carbon footprint, visualize KPIs for emissions across all buildings, and convert energy consumption and fugitive gases into CO2-equivalents based on industry standards. Track total emissions and intensity figures over time.

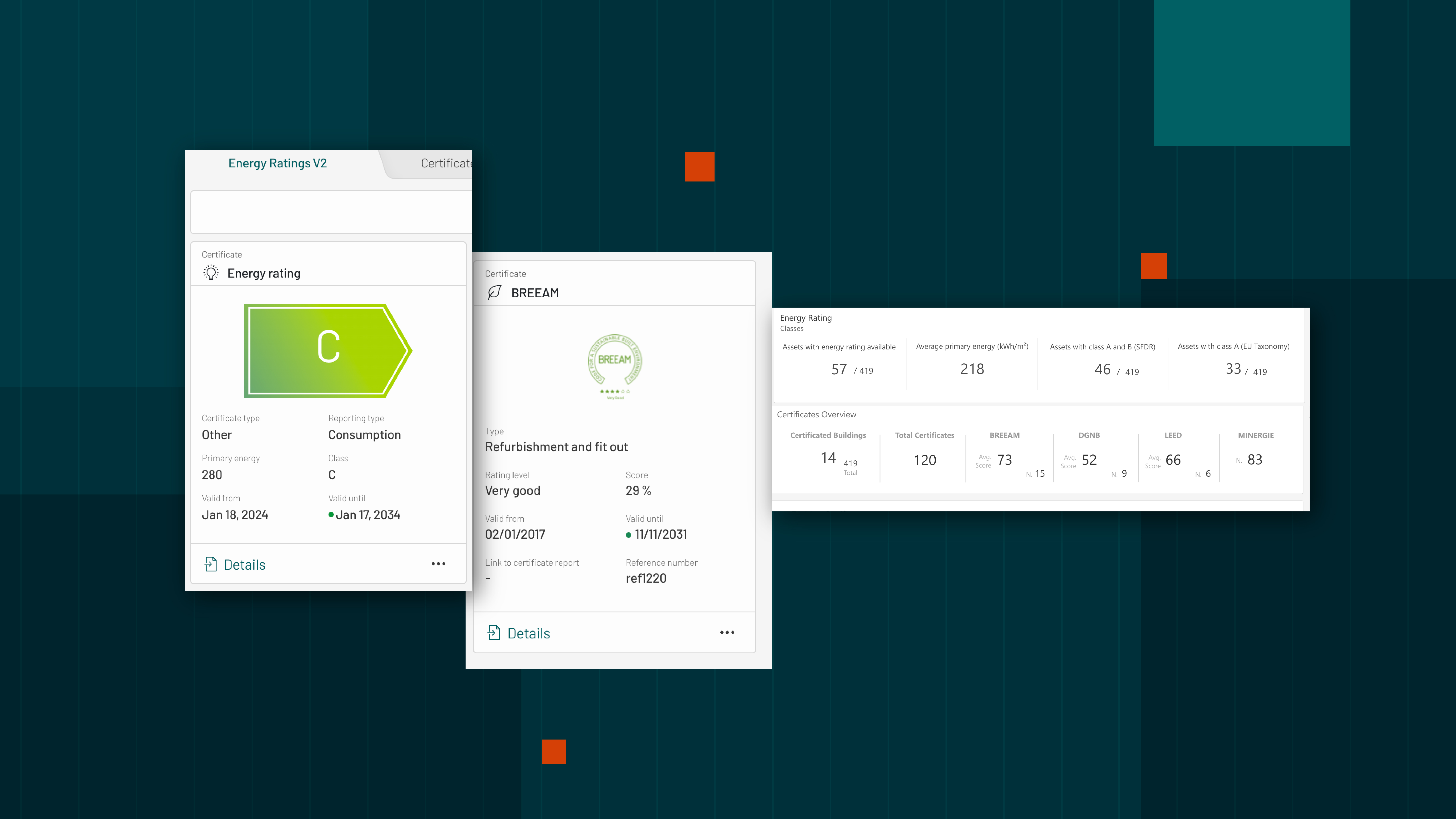

Track and action energy ratings and certificates

Get an overview across your portfolio or see an individual green building certificate, EPC or Energy Star certificate, with automated import of core data points for various certificate types, linking them to an asset's Digital Twin. The portfolio level dashboard shows the information on BREEAM, LEED, MINERGIE, HQE and DGNB certificates and view Energy Ratings from EPCs.

With BuildingMinds we are able to give our data a system-based home, so we can understand the "what is" and shape the "what will be".