Plan and implement your ESG strategy

Portfolio management

The goal of portfolio management is to keep your real estate portfolio healthy and drive value growth. We give you the tools you need to identify your buildings' resource consumption and emission levels, plan and manage sustainability and operational KPIs, and turn your ESG goals into actions with retrofit planning and impact simulations.

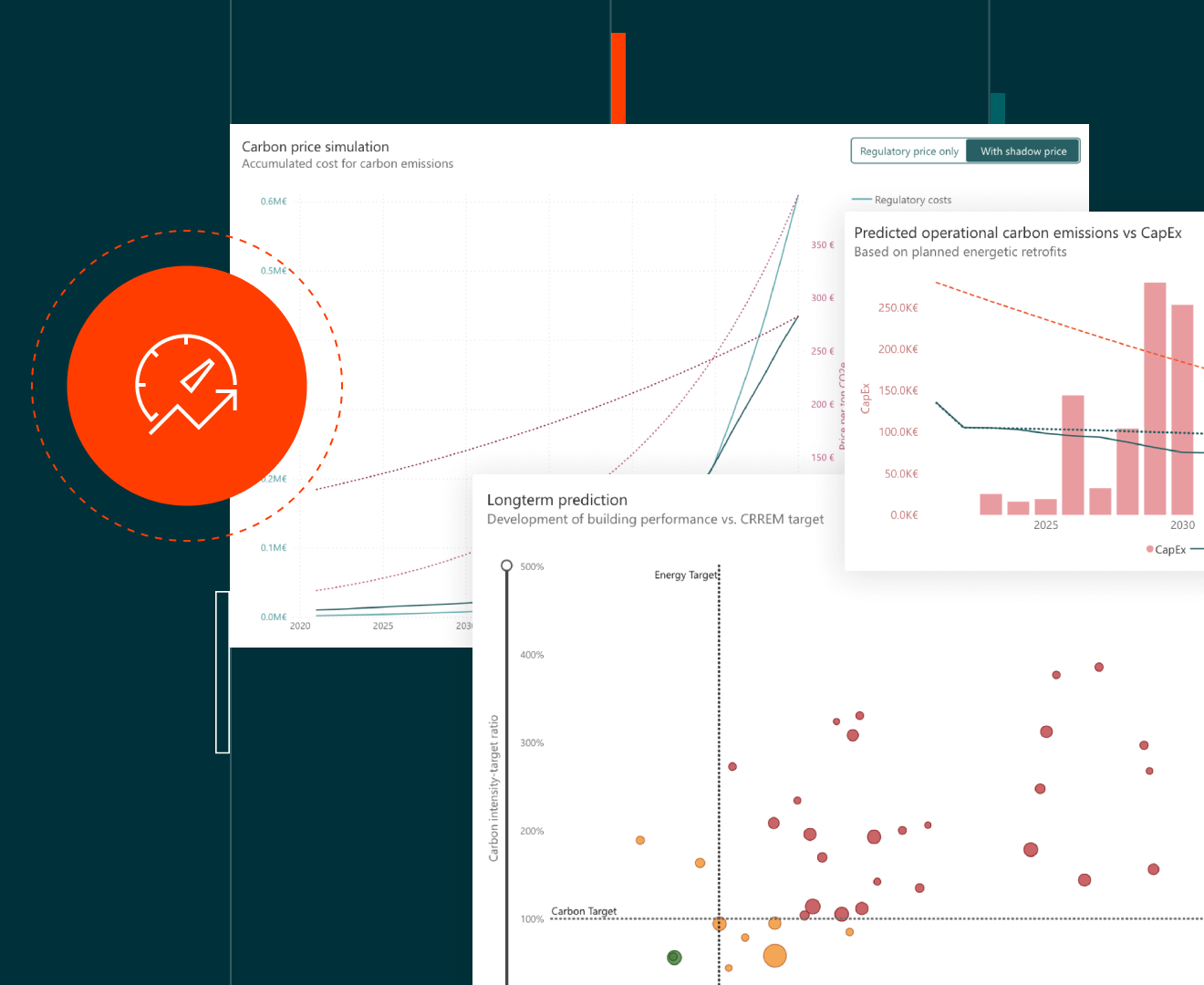

Carbon risk & cost prediction

Our solutions predict the risk of assets rapidly losing value, calculate the cost of carbon emissions on the basis of regulatory prices and help you understand the impact of physical climate risks – floods, drought, fire, thunderstorms and the like – on your real estate portfolio. We show you where assets are in danger of underperforming on all financial and ecological KPIs.

Stranded assets risk prediction

Identify any assets projected to miss their energy or emissions targets. With the help of our tools, assess transition risks and draw up an action to plan to mitigate them by increasing transparency and accountability within your organization.

Carbon footprint development prediction

Our solutions not only help you manage current emissions – they also tell you what your carbon footprint will look like in the future.

Carbon emissions cost calculation

Our platform helps you evaluate the net present value of your carbon emissions cost on the basis of anticipated regulatory prices. This allows you to understand the potential savings that you can achieve by carrying out retrofits.

Physical climate risks impact prediction

Evaluate your assets' exposure to physical climate risks across multiple scenarios and timeframes. Use this asset-level intelligence to report in ISSB-recommended format, and share the results with buyers and banks.

At Arealis, we understood early on that we cannot simply collect ESG data on a situational basis. With BuildingMinds we are able to give our data a system-based home, so that we can understand the 'what is' and shape the 'what will be'.

Retrofit planning & impact simulation

Preserve and grow the value of your portfolio. With our software you can run simulations to identify the retrofit scenario with the best balance of carbon emissions, future carbon savings, capital expenditure and wellbeing of the buildings' users.

Overview of decarbonization KPIs

Present all your decarbonization KPIs in a single report – then use this data to drive the decarbonization of your real estate portfolio.

Retrofit impact evaluation

Protect your assets from carbon risk through retrofit planning and impact analysis. Our software visually represents the impact of planned retrofits on carbon risk to help you make reliable decisions based on facts.

CAPEX planning

Carry out complex CAPEX planning based on actual carbon reduction or EUR/tCO2. Our solution uses scenarios to provide a solid basis for the investment and CAPEX-planning process.

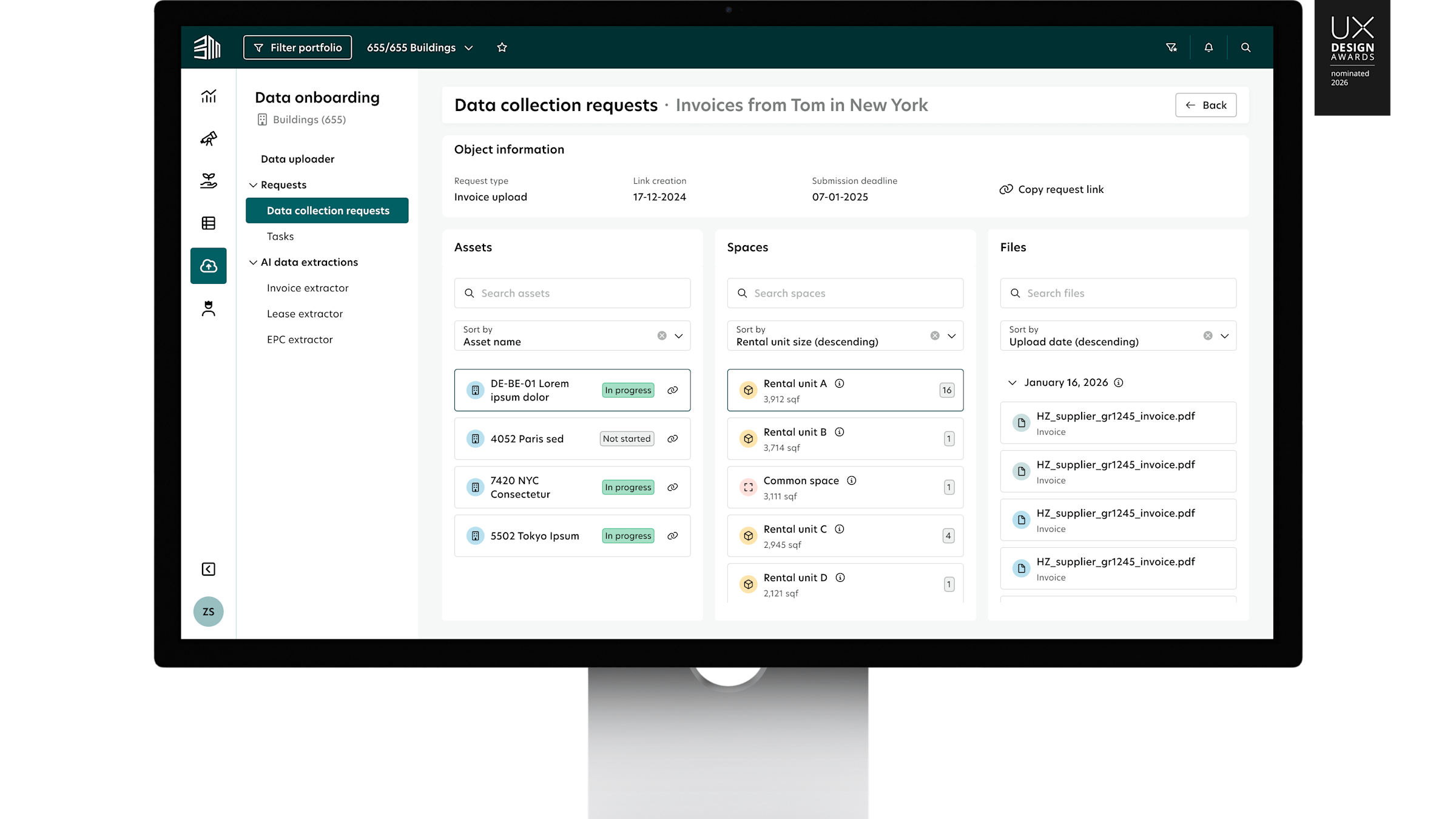

Portfolio performance management

BuildingMinds helps you maximize the value of your real estate portfolio by balancing space utilization, building costs, lease management and energy monitoring.

KPI overview

Create a simple overview of the most important financial and other KPIs across your real estate portfolio. Our system combines technical and commercial data to power your energy transition – and at the same time reduces complexity.

Lease management

Manage your lease process efficiently with the help of our easy-to-navigate platform. We can also analyze key lease information on owned and rented assets.

Costs monitoring

Track and monitor all your building-related costs. If requested, we can benchmark your real estate assets against our internal portfolio to spot any unusual data – and help you find the most effective solution to optimizing costs.

Energy performance monitoring

Monitor energy performance across your entire real estate portfolio or in individual buildings. We provide the tools you need to take back control.

Together with BuildingMinds, we are leveraging the power of ESG data to realize effective emission reductions through data modelling and reduction scenario analytics.