Regulatory changes and deadlines: A practical guide to EU Taxonomy, SFDR and CSRD

Compliance drives the ESG agenda now more than ever. Regulations such as EU Taxonomy, SFDR, and CSRD are shaping the sustainability performance of the real estate sector by establishing baseline standards, encouraging exemplary practices and enforcing adherence to environmental and social goals. But, as with all regulations, complexity is high as the number of requirements expands. The following can be used as an easy reference guide or some of the biggest reporting requirements out there today:

EU Taxonomy

The EU Taxonomy aims to provide a standardized framework for determining if an economic activity is environmentally sustainable. It’s part of the EU's broader Sustainable Finance Action Plan, aiming to channel investment toward sustainable activities to support the transition to a low-carbon, resource-efficient, and sustainable economy. It defines criteria for determining whether an economic activity contributes substantially to one of six environmental objectives:

Climate change mitigation

Climate change adaptation

Sustainable water use

Transition to a circular economy

Pollution prevention and control

Protection and restoration of biodiversity and ecosystems

Real estate activities, including construction and property management, fall within the scope of the Taxonomy Regulation. To comply, real estate companies will need to assess the environmental sustainability of their projects and operations, aligning them with the taxonomy criteria. This may involve measuring and disclosing the environmental performance of buildings, such as energy efficiency, resource use, and emissions.

What does BuildingMinds do in terms of EU Taxonomy?

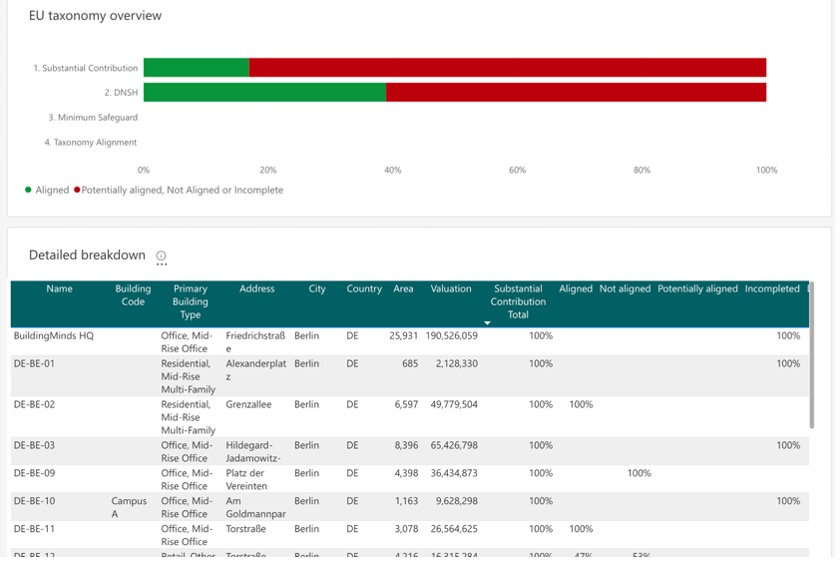

For EU Taxonomy compliance, BuildingMinds developed a solution centered around a straightforward workflow, allowing users to input building-level information related to specific objectives and activities. The platform currently covers the real estate-related section 7.7 for climate change mitigation objectives, with sections 7.1 - 7.6 planned for future integration.

Users can attach evidence for each question, ensuring thorough documentation. After completing the questionnaire for a fund, the platform offers a building readiness check feature, enabling users to assess readiness at the portfolio level and view a readiness meter for easy visualization.

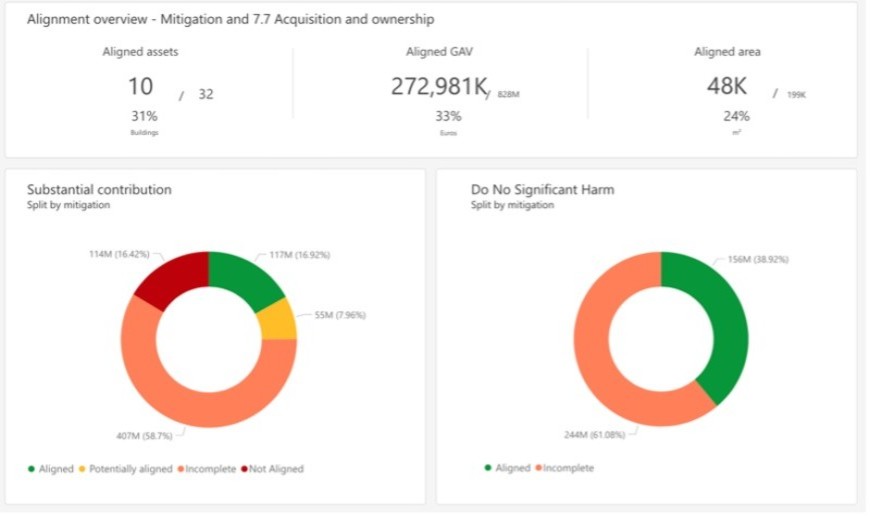

Alignment Overview for EU Taxonomy

Alignment overview across 4 key areas, including Substantial contribution and DNSH

This reporting requirement was introduced in 2020 and became mandatory on January 1st, 2023. The key articles highlighted in EU Taxonomy are Articles 7.1 to 7.7, more details can be found in our previous blog post. Relevant information can also be found on the official website of the European Commission.

Additionally, information about the EU Taxonomy Climate Delegated Act, which sets criteria for activities aiding climate change mitigation or adaptation without harming other environmental goals, can be found here.

Corporate Sustainability Reporting Directive (CSRD)

The CSRD, proposed by the European Commission in April 2021, aims to enhance transparency and consistency in sustainability reporting by extending the scope of the existing Non-Financial Reporting Directive (NFRD). It requires large companies and groups to report on a broader set of sustainability-related information, including environmental, social, and governance (ESG) factors.

The CSRD expands the reporting requirements to a broader range of companies, including listed companies, large non-listed companies, and SMEs with listed securities. It covers a wide range of sustainability topics, including environmental impact, social responsibility, diversity, human rights, and anti-corruption measures.

Real estate companies, particularly those listed on European stock exchanges or operating as large entities, will need to expand their sustainability reporting to comply with the CSRD. This may involve disclosing more comprehensive data on environmental performance, such as energy consumption, greenhouse gas emissions, waste management, and water usage, as well as social and governance-related metrics.

The CSRD impacts EU companies that meet two of the following three criteria: $40 million in net revenue, $20 million in assets, or 250 or more employees. It also includes Non-EU companies if they have substantial operations within the EU, including a physical presence and a net revenue of $160 million in the EU for each of the last two years and possessing an EU subsidiary listed on the stock exchange that generated a net turnover exceeding $40 million in the preceding year.

The CSRD came into force on January 1, 2024, affecting around 50,000 companies in the EU which makes up 75% of the total revenues of EU companies, as well as an estimated 10,000 or more companies globally.

Introducing our newest tool: The CSRD Compliance Compass, now available and free to use. By answering relevant questions about your organization’s sustainability reporting strategy, BuildingMinds helps you navigate the complexities of CSRD compliance.

Sustainable Finance Disclosure Regulation (SFDR)

SFDR aims to improve transparency and disclosure of sustainability-related information in the financial services sector, ensuring that investors have access to relevant ESG information when making investment decisions. It requires financial market participants and financial advisors to disclose how they integrate sustainability risks into their investment decision-making processes.

SFDR applies to a wide range of financial market participants, including asset managers, investment funds, pension funds, insurance companies, and investment advisors. It imposes disclosure obligations on these entities regarding their sustainability policies, procedures, and the integration of sustainability risks into investment decisions.

Real estate investment funds, asset managers, and other financial market participants involved in real estate investments will need to comply with SFDR by disclosing information on how they consider sustainability risks and factors in their investment strategies and decision-making processes. This may involve providing information on the environmental impact of real estate assets, such as energy efficiency ratings, green certifications, and climate-related risks.

Although SFDR has been applicable since March 2021, it didn’t become mandatory until January 1st, 2023, when it entered the level 2 phase. ESMA has recently put forth a proposal to revise the Delegated Regulation supplementing SFDR, slated for adoption by the European Commission throughout 2024, with intended implementation in January 2025. They proposed adding new social indicators and streamlining the framework for the disclosure of principal adverse impacts of investment decisions on the environment and society.

Additionally, the European Commission is undertaking a thorough evaluation of the SFDR framework, potentially resulting in a legislative review in 2025. More information about SFDR can be found on the official website of the European Commission.

BuildingMinds and SFDR compliance

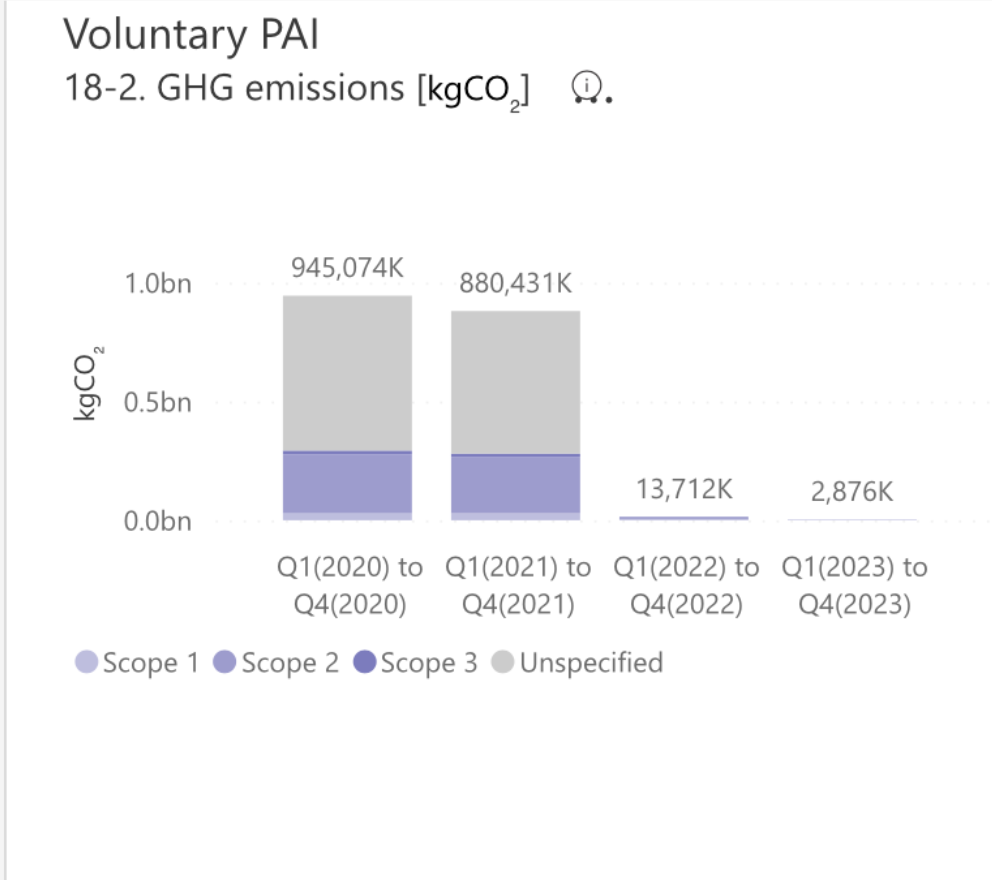

For SFDR reporting, the BuildingMinds platform automatically collects Principle Adverse Impact (PAI) data, helping companies comply with the sustainability requirements for Article 8 and 9 funds. The platform offers dashboards that compare data over three years, allowing for both quarterly and annual reporting. KPIs are generated based on building-level information and can be reported at the fund and company levels. Moreover, BuildingMinds provides the percentage of estimated and metered data points for a comprehensive understanding of the portfolio's sustainability performance.

Voluntary PAI and energy consumption intensity

Stay Connected

If you’re interested in knowing more about our platform and how it helps you achieve compliance with regulations and reporting standards, reach out to our experts and request a meeting today.