Safeguarding Asset Values: A Blueprint for Asset Managers in Sustainable Investment and Value Preservation

Real estate owners don’t need detailed research to prove that operational efficiency and sustainability are not mutually exclusive. The extent of the positive correlation between the two might surprise you. According to the ESG and Global Investor Returns study by Kroll covering around 13.000 companies across different industries in various parts of the world, companies with better ESG scores had superior annual returns, reaching 12.9% versus 8.6% for organizations with no active ESG strategy.

The practice of integrating sustainability and efficiency factors into traditional financial models is not widely applied, and the limited historical data on sustainable investments adds complexity. Overcoming these challenges requires industry collaboration, regulatory support, and ongoing innovation in measurement and reporting practices.

"Regardless of the economic cycle we are in, asset owners have an obligation to investors as well as occupiers to ensure a proven plan is in place to boost a building’s climate resilience.” Hannah Stern – Chief Commercial Officer at BuildingMinds.

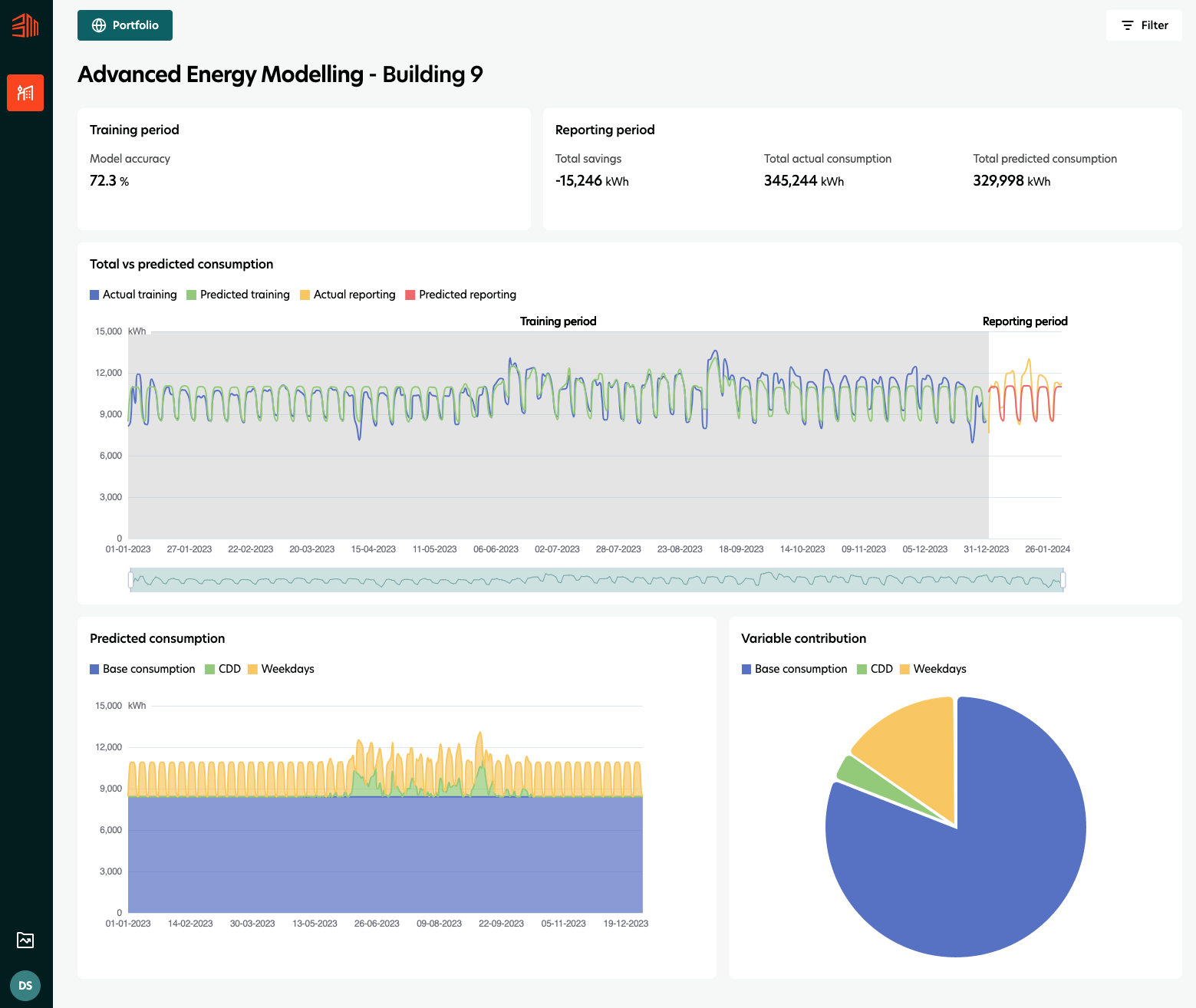

BuildingMinds provides asset managers the ability to not just monitor energy consumption via the utility monitoring dashboard; this will also leverage regression models to predict future energy consumption, and thus forecast a key contributor to OpEx.

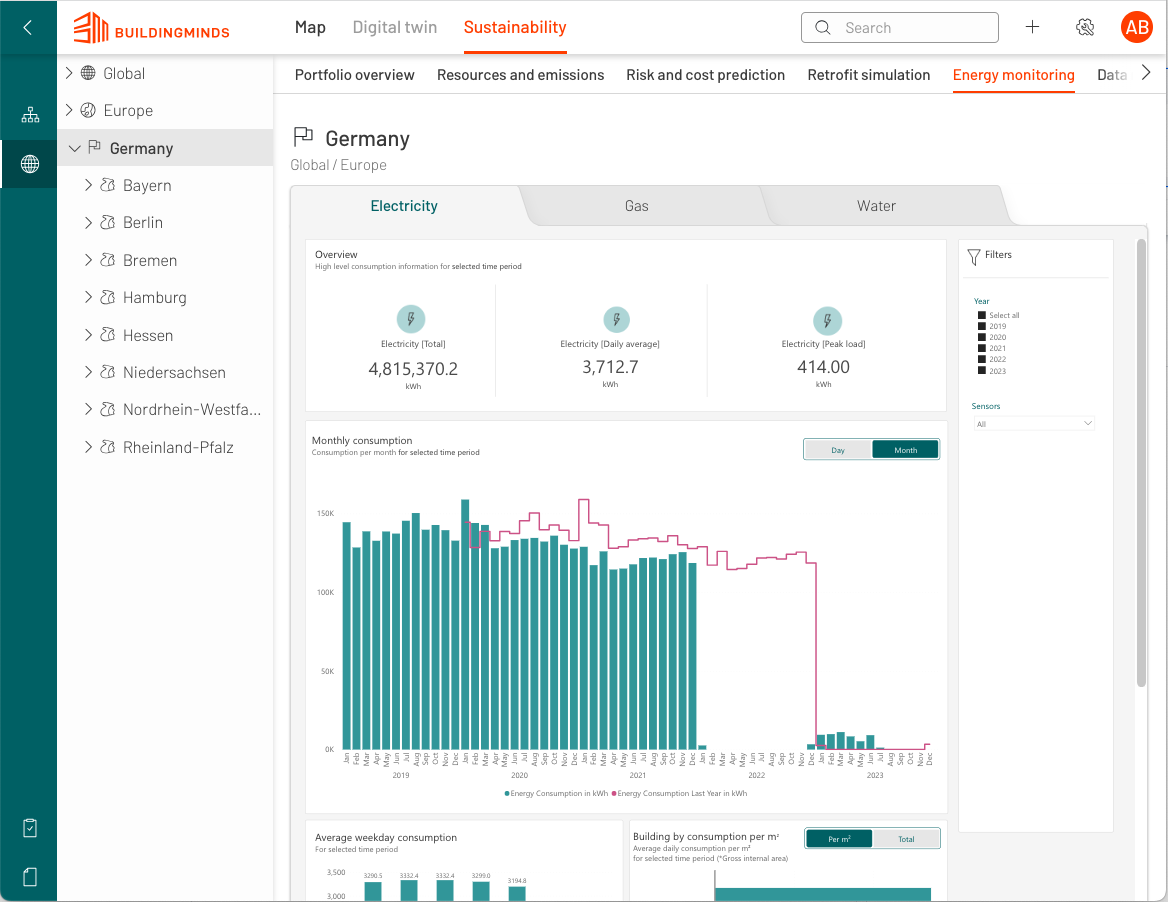

Energy Consumption Monitoring

Predictive Analytics to Forecast Energy Consumption

As energy prices continue to rise, managing energy consumption has become a key factor in NOI. BuildingMinds helps real estate stakeholders monitor the level of energy consumption across their buildings. This enables users to identify outliers and, ultimately, to measure the effectiveness of capital improvements in making an asset sustainable and managing costs.

Implementing Risk Management

Asset managers have to address potential risks that could impact the resilience and success of their portfolios. This includes:

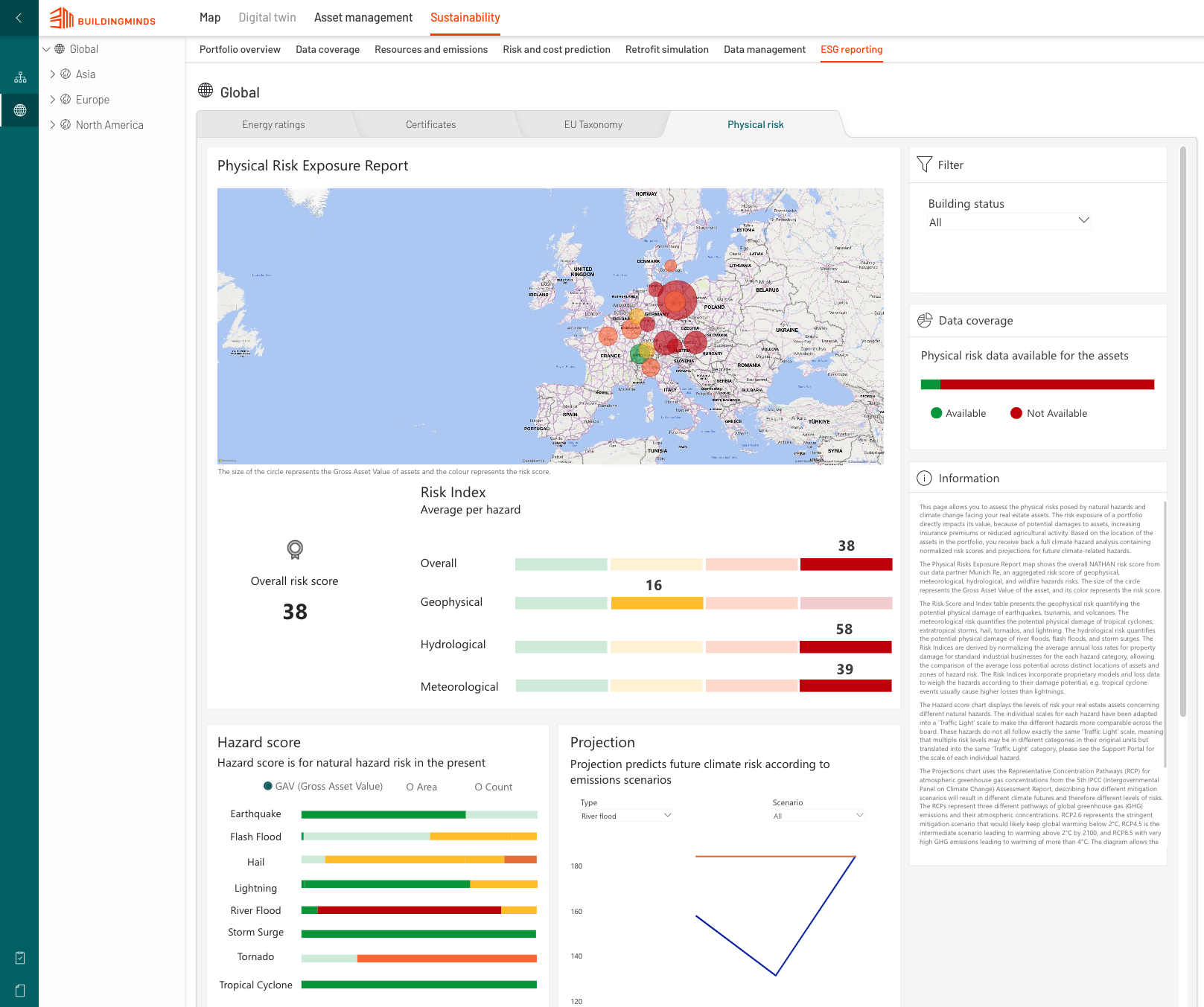

Physical risk: This encompasses natural causes such as earthquakes as well as those intensified by global warming (e.g. sea-level rise or hurricanes). Understanding, heeding against, and ultimately building resiliency for climate expected loss is a key part of any asset holder’s strategy today. Having accurate data to do this is essential. BuildingMinds helps asset owners forecast climate expected loss and is working to provide projections of the pure insurance premium associated with the profile of a given asset.

Physical Risk Exposure Report

Market risk: Stranding risk makes assets obsolete or financially non-viable before the end of their expected economic life. This risk can be driven by changes in technology, regulatory developments, shifts in occupier preferences, changes in interest rates, or other external factors. Some are nearly impossible to predict, while others require planning and strategy. Here as well, the BuildingMinds platform can help. As the only decarbonization platform in the market with direct integration to the industry-standard CRREM (v1 and 2) pathways to assess stranding risk, asset owners can run multiple passive and active scenarios where various combinations of retrofits are included – or not - depending on the desired outcome.

Stay Connected

If you’re interested in knowing more about our platform and how it helps you achieve real estate sustainability, reach out to our experts and request a meeting today.