SFDR reporting 2023: what it is, who it concerns and how to comply.

What is SFDR?

SFDR is part of a broader package of legislative tools designed to direct capital towards sustainable businesses. Proposed by the European Supervisory Authorities (ESAs), SFDR standardizes the information that needs to be disclosed and reported.

But what exactly makes an investment sustainable?

According to SFDR, a sustainable investment should comply with the precautionary principles of “Do No Significant Harm“ (DNSH). Going a step further, there are three different fund categorizations:

SFDR article 9 covers products whose specific target is sustainable investments, with the objective to be designated as a reference benchmark

SFDR article 8 applies to funds that further environmental and social aspects, while following good governance practices

SFDR article 6 – no related sustainable activity is disclosed or the activity does significant harm

Who does SFDR apply to?

SFDR mainly applies to Financial Market Participants (FMP), meaning investment firms such as asset managers who offer portfolio management services, providers of pensions products and insurance-based investors. SFDR Regulations

In April 2022, the European Commission adopted the final Regulatory Technical Standards (RTS) under SFDR. The objective of the RTS is to ensure that participants disclose relevant information on products with a sustainable investment initiative for products that can be classified with SFDR Articles 8 and 9, and to facilitate the comparison between investors.

SFDR Reporting & Principle Adverse Impacts

According to SFDR, sustainable investments should be reported based on the Principal for Adverse Impacts (PAI) framework. Principle Adverse Impacts are defined as negative, material or likely to be material effects on sustainability factors that are caused, compounded by or directly linked to investment decisions and advice performed by the legal entity. When it comes to investments in real estate assets, the disclosure of the PAIs (Principal Adverse Impacts) should include the 2 mandatory indicators: fossil fuels exposure and energy efficiency; and at least one of the voluntary, which includes GHG emissions, energy consumption, waste and biodiversity.

The time for SFDR reporting is now

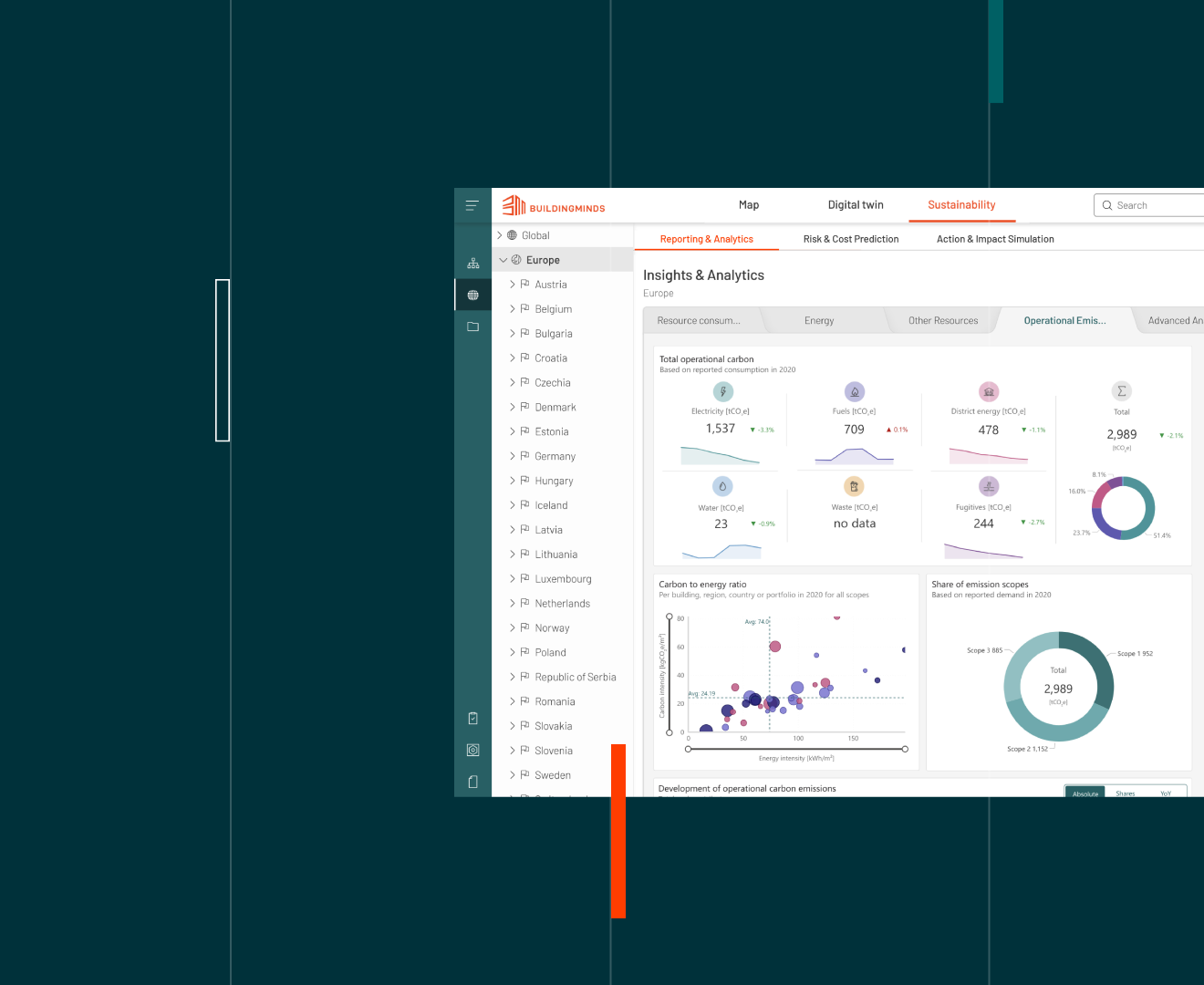

With deadlines fast approaching, there’s no time to waste. Tackle SFDR reporting together with BuildingMinds and turn that acronym into „Simple, Fast and Direct Reporting“. And the cherry on top? You’ll be able to reuse the data you captured for multiple ESG reporting standards.

BuildingMinds’ got you covered

We know, that might take a second to wrap your head around. But here’s the good news: BuildingMinds’ ESG solution can support you with specifically designed features like data collection, carbon risk analysis, energetic retrofit simulations – and much more. In fact, our SFDR module covers all the PAIs below.Mandatory: Fossil fuels – Exposure to fossil fuels through real estate assets

Investments in real estate assets involved in the extraction, storage, transport or manufacture of fossil fuels (€M)

% portfolio coverage

Mandatory: Energy efficiency – Exposure to energy-inefficient real estate assets

Value of real estate assets built before 31/12/2020 with EPC of C or below (€M)

Value of real estate assets built after 31/12/2020 with PED (Primary Energy Demand) below NZEB in Directive 2010/31/EU (€M)

Value of real estate assets required to abide by EPC and NZEB rules (€M)

Voluntary: Greenhouse gas emissions – GHG emissions

Scope 1 (tCO2e)

Scope 2 (tCO2e)

Scope 3 (tCO2e)

Current value of investment (€M)

Investee company’s enterprise value (€M)

Voluntary: Energy consumption – Energy consumption intensity

Energy consumption (kWh)

Floor area (m²)

Voluntary: Biodiversity – Land artificialisation

Non-vegetated surface area (m²)

Total surface area of the plots of all assets (m²)

Non-vegetated surface area/ total surface area (m²)

Voluntary: Waste

Hazardous waste ratio

The complete SFDR checklist

Want to get the full picture on what a comprehensive SFDR report should contain? Here’s a complete checklist to help you make sure you’ve got everything covered.For SFDR Article 8 (according to Article 32 of SFDR)

Summary

No sustainable investment objective

Environmental or social characteristics of the financial product

Investment strategy

Proportion of investments

Monitoring of environmental or social characteristics

Methodologies

Data sources and processing

Limitations to methodologies and data

Due diligence

Engagement policies

Where an index is designated as a reference benchmark for the purpose of attaining the environmental or social characteristics promoted by the financial product, Designated reference benchmark.

For SFDR Article 9

Summary

No significant harm to the sustainable investment objective

Sustainable investment objective of the financial product

Investment strategy

Proportion of investments

Monitoring of environmental or social characteristics

Methodologies

Data sources and processing

Limitations to methodologies and data

Due diligence

Engagement policies

Attainment of the sustainable investment objective

Data sources

According to Article 40 and 53 of SFDR, the section for “Data sources and processing” must contain:

The data sources used to attain each of the environmental or social characteristics promoted by the financial product

The measures taken to ensure data quality

How data is processed

The proportion of data that is estimated