The Risks of Waiting to Act on Net Zero Strategies in Real Estate

The real estate industry is at a crossroads when it comes to decarbonization and reducing greenhouse gases by 2050. Immediate action is needed now to tackle the climate crisis and mitigate the stranding risk that building portfolios may face. In Europe, buildings represent the highest energy consumption source, making it crucial for the real estate industry to achieve its climate goals. According to the European Environmental Agency Greenhouse Gas Inventory, published in 2023, 85% of EU buildings were built before the 2000s and amongst those, 75% have a poor energy performance. Improving the energy efficiency of buildings is essential for property managers and investors to be compliant with the ever-changing ESG regulations and achieve the net-zero goals by 2050 and ultimately increase the asset value.

The downside of a “Wait and See” approach

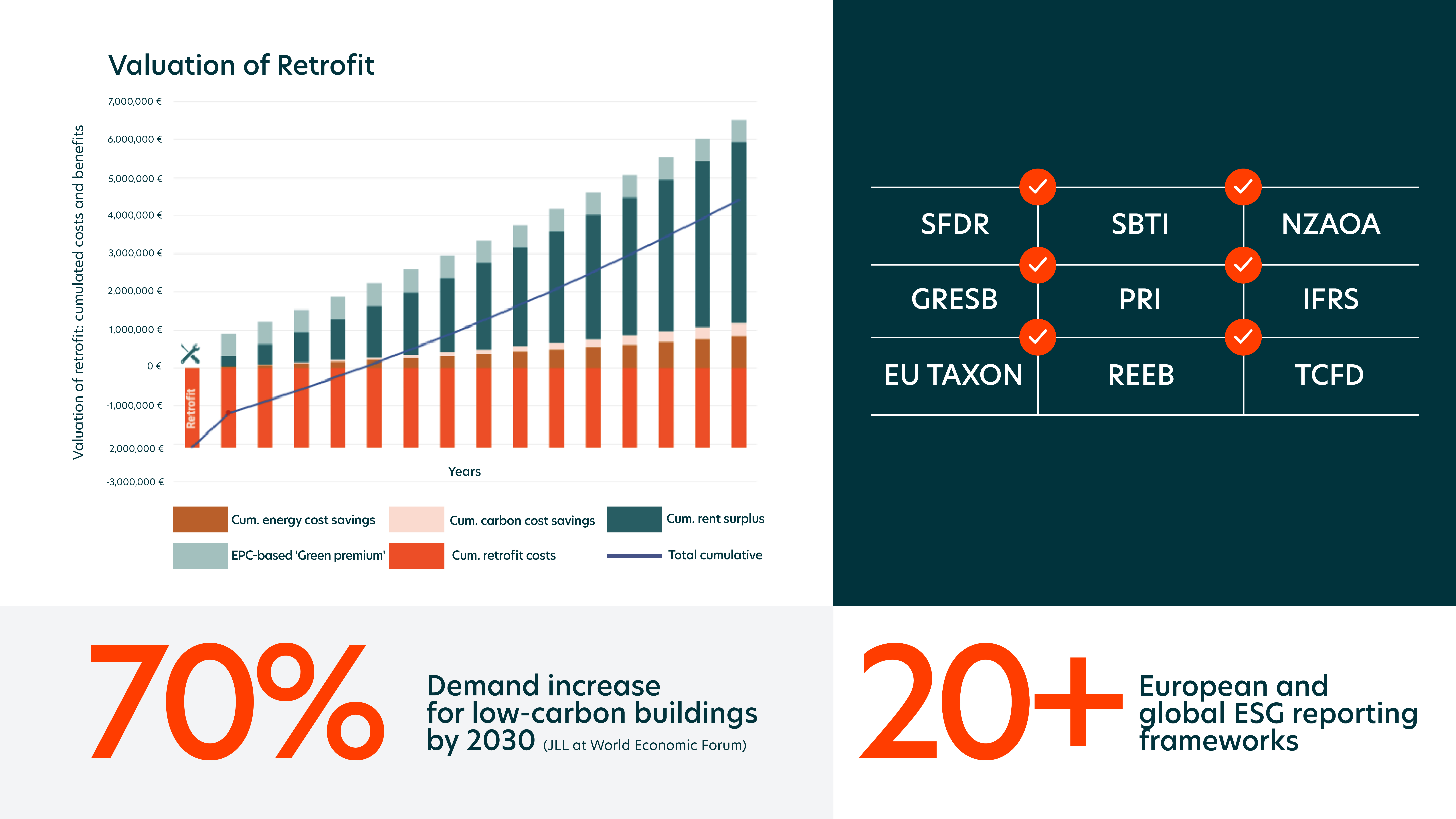

It is clear that real estate industry can no longer delay investments for green buildings, as such delays may lead to “brown discounts”, which can negatively impact portfolio values. According to a recent survey by the World Built Environment Forum (2021), over 30% of respondents suggest that, even if there is no rent or price premium, buildings that are not considered “green or sustainable” are subject to a brown discount. That being said, the appetite of investors towards green buildings investments is rising. The RICS Sustainable Building Index 2023 reported a net balance reading of 44% regarding the investor demand for green assets, followed by a net balance reading of 48% in 2022 and 55% in 2021. In 2023, the highest demand for green assets was recorded in Europe, especially in the UK with a net balance of 73%. However, there might be challenges in encouraging green investments due to high initial costs, lack of evidence in ROI and initial uncertainty around benefits.

It will be up to policymakers and the real estate industry leaders to allocate short and long term funds and train talents to tackle complex challenges of decarbonization. Besides allocating funds to avoid brown discounts, driving a seamless and transparent data management process is crucial in the decarbonization journey for the leading players in the real estate industry. Creating comparability is also a key aspect for organizations to reduce carbon emissions. Such comparability should be based on measurement standards that aim to merge all calculation methodologies to drive sustainable investments. Furthermore, tenant engagement is becoming an important factor in taking action to lower carbon emissions. As stated by Better Buildings, an initiative from the U.S. Department of Energy (DOE), tenants are responsible for approximately 80% of CO2 emissions in commercial buildings. Last but not least, real estate companies need to be at the forefront in implementing cutting-edge digital solutions that enable them to streamline global and local ESG reporting (EU Taxonomy, CSRD, SFDR) and implement physical and climate assessment solutions to mitigate the impact of their portfolio on climate change, hence increasing asset value, as highlighted by RICS.

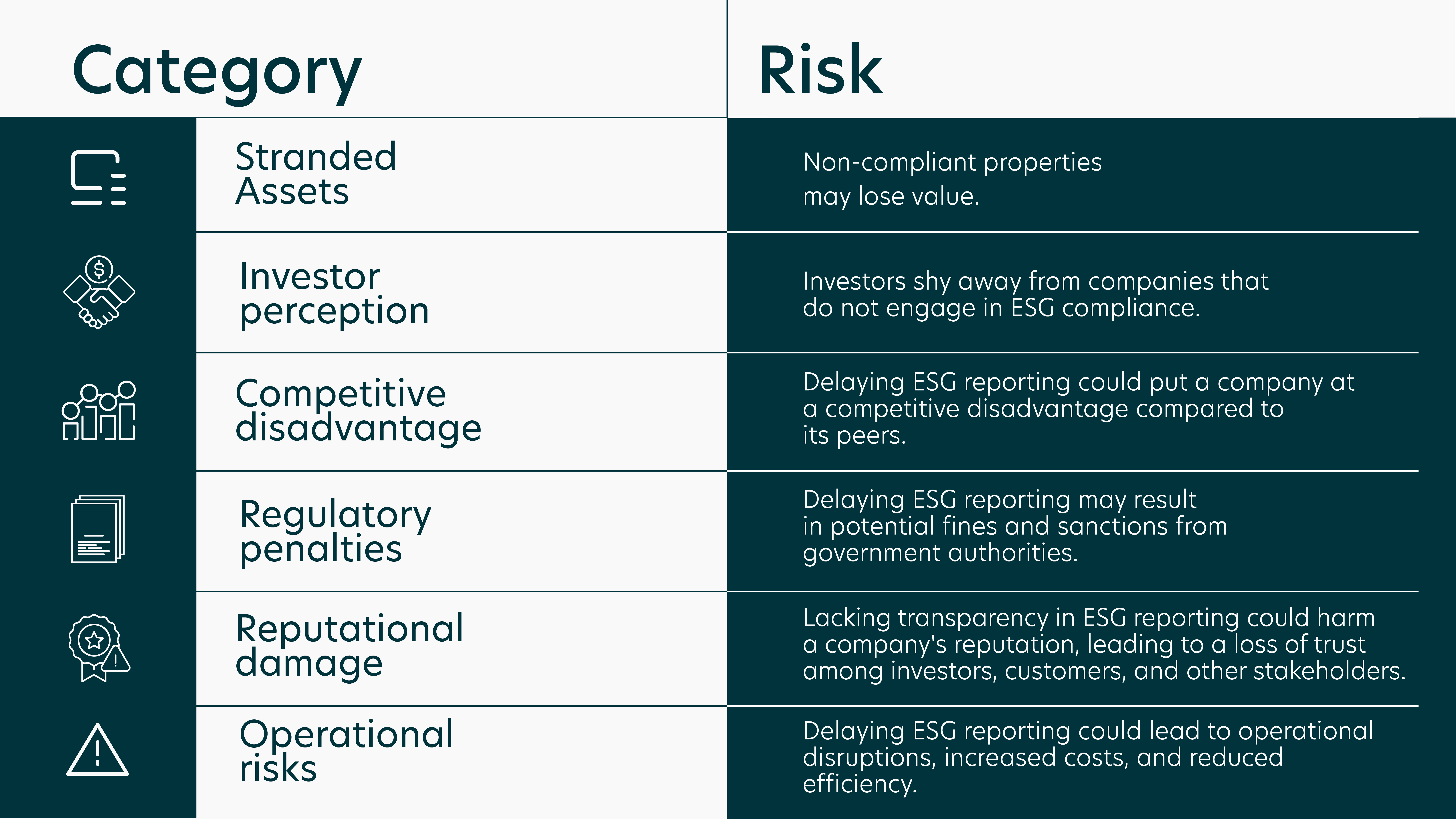

Potential risks that real estate players may face

Streamlining ESG reporting with BuildingMinds to drive ROI

According to a study conducted by JLL, it has been projected that the demand for low-carbon emission buildings will grow by 70% by 2030. BuildingMinds is revolutionizing the ESG landscape by offering a comprehensive global ESG reporting coverage tailored for asset and ESG managers. Our cutting-edge solution empowers ESG and asset managers to stay ahead of the curve by seamlessly adapting to the ever-changing ESG regulations and drive return on investment (ROI) across their portfolio. This streamlined process ensures a bespoke solution for specific reporting needs and designed to be an integral component of our product offering, ensuring that both ESG and asset managers have the tools they need to make informed decisions and improve their financial outcomes.

With detailed and interactive dashboards asset and ESG managers can manage consumption data and energy sources from a portfolio, down to a building level, visualize KPIs impacting operational carbon emissions across the portfolio or any subset of buildings and automatically convert energy consumption and fugitive emissions into CO2-equivalents, according to industry standards

As prioritizing long-term sustainable growth in the real estate sector, the industry needs to find a balance between facing financial pressures, drive ROI and commit to long-term ESG goals to drive impactful change. In a recent survey conducted by BuildingMinds and GRI Club, on the impact of ESG practices on the asset value has displayed a staggering interest and confidence regarding the impact of ESG actions on the increase of the asset value. A great share of respondents believes that poor ESG performance would have a negative impact on operational cashflows, and that investors’ focus leans more towards green investments, whereas a small share of respondents expressed lack of confidence in their organizations’ ability to engage in ESG activities.

As the real estate markets is rapidly evolving, it is evident that implementing ESG strategies can drive a significant positive impact on asset valuation, leading to enhanced long-term financial performance and risk mitigation on building portfolios. However, the current lack of confidence in applying ESG strategies may weigh on the decision-making process for many organizations. To overcome this challenge, it is crucial for stakeholders to keep innovating and invest in state-of-the-art technologies, continuous education and training and ensure seamless collaboration across multiple stakeholders in using the right tools to stay at the forefront with ESG reporting compliance.