Transforming Europe's Commercial Real Estate: Pursuing Sustainable ROI Through Effective Retrofit Measures

Overview of the European commercial real estate market heading in 2025

According to a recent report, conducted by Cushman and Wakefield, the European commercial real estate is gaining momentum heading into 2025. With more stable labor markets and financing conditions, prime office rental growth is predicted to be at the forefront, with an average increase of 2.1% throughout Europe in 2025, followed by retail and logistics with an anticipated growth rate of 1.9%, as Cushman and Wakefield projects. Most European prime office markets, including cities like London, Brussels, Madrid, and Barcelona are expected to show strong demand and stable occupancy fundamentals. Driving the market is a growing preference for top-quality properties and prime locations. Currently, Grade A leases constitute more than 50% of activity in major cities, an increase from just above 40% in 2019.

Jens Hirsch, Chief Scientific Officer at BuildingMinds states that “Beyond 2025, the unwavering commitment to curbing carbon emissions and confronting climate risks will be a core component of long-term approaches. We can anticipate that evolving EU regulations will notably affect asset valuations, leasing agreements, and tenant demand”. Additionally, asset repositioning and repurposing are predicted to gain traction, particularly in major urban centers like London and Paris. Meanwhile, peripheral office spaces may experience a decline in demand, rendering repurposing a practical solution for outdated buildings.

According to a JLL recent study, 322 to 425 million square meters of existing office space across 66 major markets worldwide will need significant capital investments, ranging from 904 billion euros to 1.1 trillion euros, over the next five years to remain operational. Globally, stranding risk is not equally spread. The U.S. is expected to face 44% of this risk due to high amounts of unused properties, while Europe may experience 34% of the risk as people tend to prefer higher quality office spaces, leaving a considerable number of vacant properties with low demand.

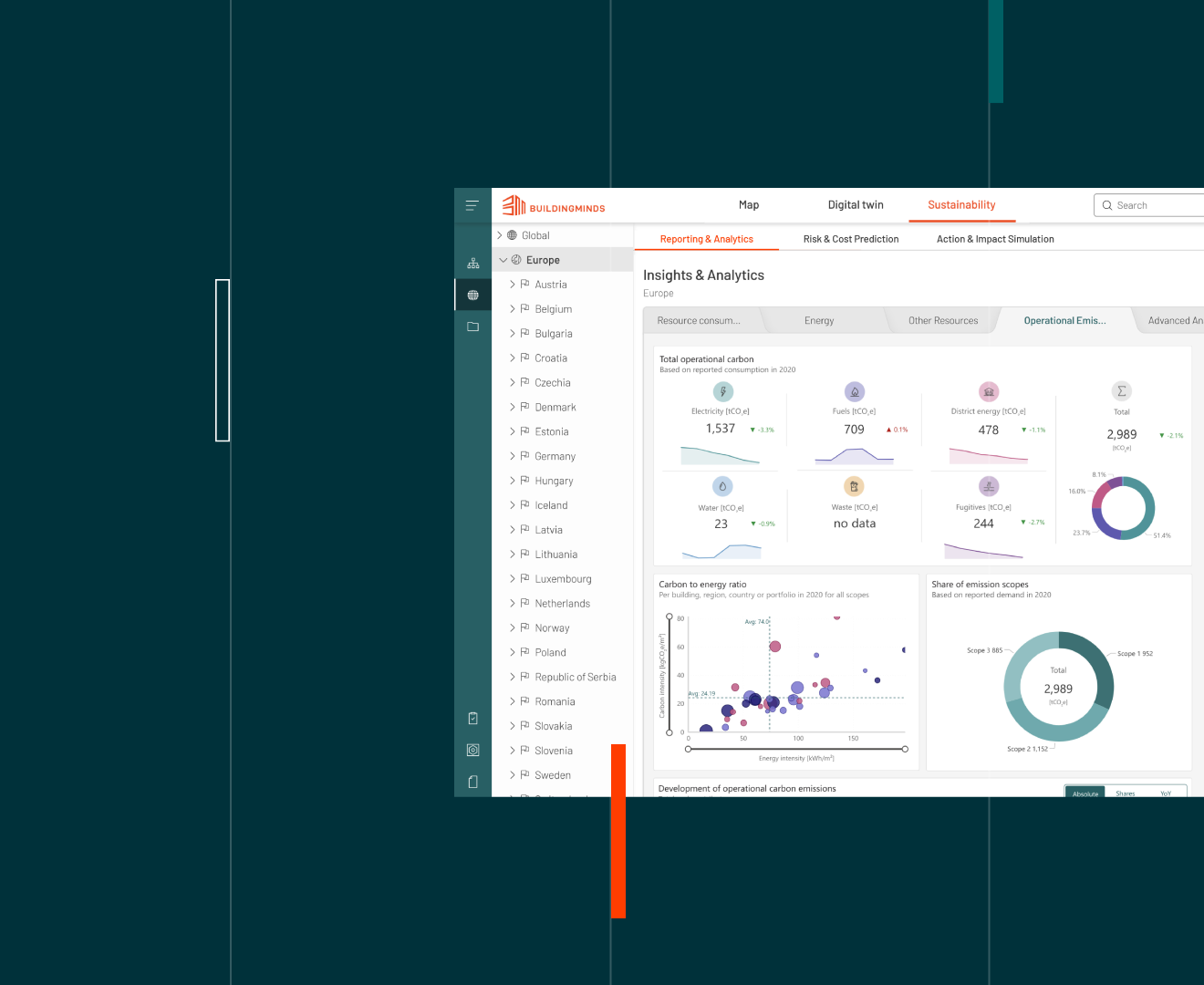

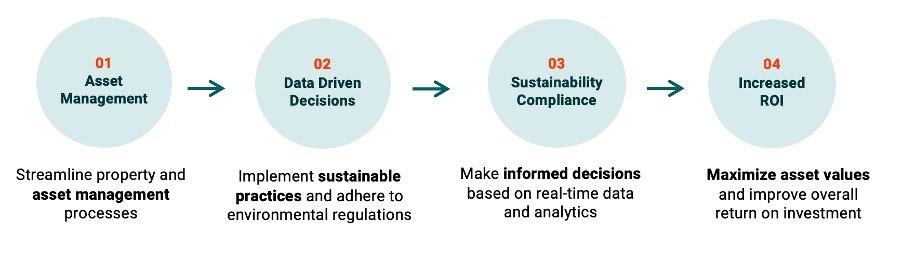

Boosting ROI with BuildingMinds' Retrofit Tool

The Retrofit Recommender is a machine learning-trained tool that supports asset managers and investors in decarbonizing their portfolios. By leveraging AI, the tool identifies the most efficient retrofit measures to decrease the asset’s energy consumption and improve CO2 efficiency. It also provides an estimated budget for the investment through the setup of financial KPIs.

The BuildingMinds Retrofit Recommender can be leveraged to analyze individual buildings and identify the requirements around specific interventions, such as insulation, LED lighting or on-site renewables, as well as additional measures aiming to increase the asset value. ESG and asset managers, from top real estate firms employ this tool to identify efficient strategies. By optimizing their Net Operating Income, adhering to ESG regulations, and enhancing the value of their current building portfolio, they ensure sustainable and profitable growth.

Expected 70% surge in the demand of low-carbon buildings by 2030

As we approach the year 2030, investors and asset managers will likely face tougher complex challenges related to the monitoring and reporting of CO2 emissions within their portfolio. On top of that, they must continually prove the optimization of operational efficiency throughout their real estate holdings.

In a recently conducted study, JLL estimates that 80% of today’s buildings will still be in use by 2050, making it essential to promptly reassess their overall energy efficiency.

Investing in the refurbishment of existing building stock is not only crucial for achieving environmental objectives, but also for investors seeking higher profits. By focusing on retrofitting rather than building completely new assets property values can be increased while energy costs are reduced.

Promoting brown-to green investment has been found to drive a higher return, compared to investing in constructing green assets from the beginning. According to a GRESB analysis, allocating capital to improve "brown" assets can have a higher impact on reducing emissions rather than investing in already green assets. The study conducted with the GRESB database showed that upgrading brown assets to a reasonable standard can result in 30 times more emissions reductions compared to investing in green premium assets.

In essence, the future of our urban landscapes relies on our ability to transform the buildings we already have into sustainable, efficient, and desirable spaces.