What gets reported gets managed? Time to prove green impact.

Reading time 9 minutes - enjoy the read!

The “go green movement” has been oversold. Although the number of companies pledging ESG and filing corporate social responsibility reports has increased a hundredfold in the past two decades, carbon emissions have kept rising and environmental damage has accelerated.

Remember 2008?

Like 2008, when financial rating companies came under scrutiny during the turmoil of the subprime recession, ESG raters are facing inconsistent, incomplete or -even unintentional- wrongful disclosures and misinterpretation of ESG-labelled products today.

The plethora of standard setters, raters, and frameworks have led to structural measurement and reporting incongruencies creating the opposite effect of intended transparency. Researchers at MIT’s Sloan School of Management recently conducted a study of six top ESG ratings firms and concluded that “ratings from different providers disagree substantially… The correlations between the ratings are on average 0.54 and range from 0.38 to 0.71. This means that the information that decision-makers receive from ESG rating agencies is relatively noisy.” As of 2022, it is no longer going to be enough to simply tick a regulatory box.

What’s moving the needle: Article 8 and 9

First movers are shifting gears. Regulatory and disclosure requirements will still continue to drive transparency, however the trend to classify as Article 8 and sometimes even 9 will require companies to define concrete, measurable actions – companies with clear sustainability benchmarks will gain attractiveness, those without will feel the pressure.

According to Morningstar, although the investment industry is still adjusting to the measures, and uncertainties about Article 8 and Article 9 classifications persist, funds classified as Article 8 and 9 currently represent up to 21% of total European funds and up to 25% of total European fund assets. Of these, 18% were classified as Article 8 and 3.6% as Article 9.

"The proportion of funds classifying themselves as Article 8 and 9 was surprising, given that many managers are still analyzing what the extra disclosure requirements entail."

Morningstar

The hard part after the pledge: Taking action

43% of investors say they have a net-zero carbon goal. Another 28% expect to have one within the next 12 months. It all sounds great and responsible, but the most arduous part is what follows the commitment: Taking action and measuring the impact.

For Article 9 funds that track a reference benchmark for instance, the fund must provide a summary of how it compares with the benchmark in performance and sustainability indicators such as any sustainability indicators deemed relevant by the Fund Manager. Precise controls and processes have to be put in place to gain transparency and comparability on the real sustainability impact of financial products, the underlying sustainability profile of issuers and the methodologies underpinning ESG ratings and data in general.

The elephant in the room: Data

Asset managers and other investors need reliable and comparable ESG data to comply with regulatory requirements, support their sustainable investments and enable the shift towards investing in greener economies.

These data needs are currently not fulfilled. Data availability issues stem from data gathering restrictions and difficulties, the currently limited number of companies disclosing ESG-related information, as well as the insufficient granularity of the disclosures. Data quality issues, in turn, relate mostly to the lack of standardization and their poor reliability as companies tend to report selectively against different frameworks and to use different approaches and proxies with limited transparency on the methodologies and the data sources. Linked to that, the scarcity of publicly disclosed information combined with significant market concentration regarding ESG rating and data providers translate into high data costs.

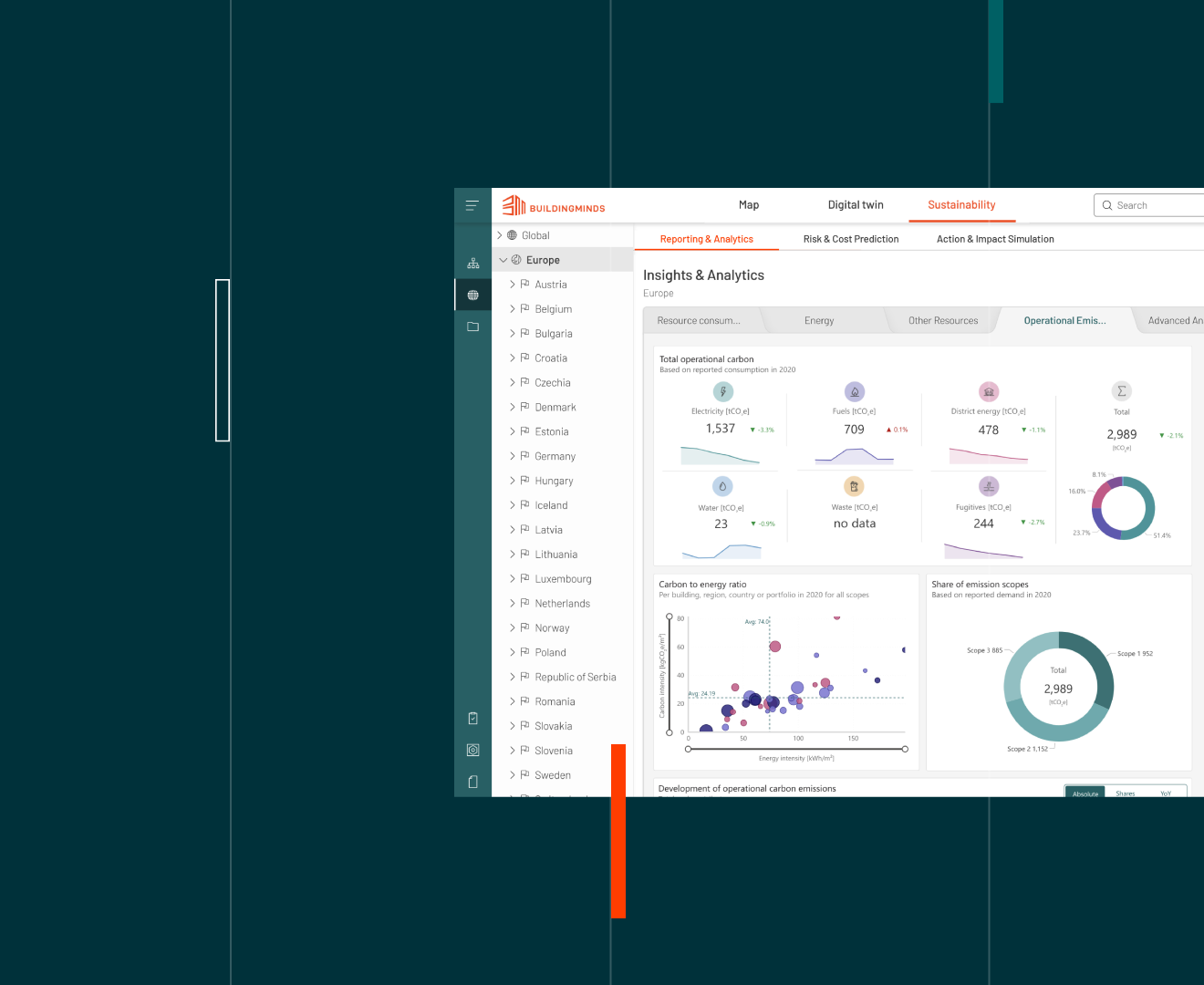

Excel won’t save the planet - and the business. If we want to combine impact and portfolio resilience in the future, there is no alternative to large scale digitalization. Data-driven analytics can uncover underlying trends and new potential not identified by traditional methods. McKinsey estimates that nearly 60% of predictive power will have to come from non-traditional variables. Smart AI implementation is key to processing vast amounts of data and gaining critical insights from previously unrelated data points.

Tapping into all static information and dynamic data isn’t just a necessary business priority, it also provides the framework for the integration of future technologies such as Artificial Intelligence. To manage the increasingly complex analytical tasks, dynamic calculation models need to be created, implemented, and monitored. The models will incorporate CO2 taxonomy, compliance, investment, retrofitting, valuation, rental/leasing conditions, transactions, material, technology, etc. All of these will have to be aligned with companies’ strategic and tactical goals.

"Finally, any ESG strategy will have to go hand-in-hand with an organizational restructuring and a digitalization strategy. What gets measured gets managed."

Pia Maria Goossens, Senior Account Executive BuildingMinds

What’s changing the equation

Measurement may be limited to specific indicators that do not cover the full width of impact objectives. It may be supplemented by case studies. It may evolve. Or it may not even be in place at the beginning. However, what changes the game is to genuinely attempt to measure impact quantitatively and in a clearly defined, realistic time frame.

1. Define clear goals first

It is vital to factor the process of setting objectives, establishing targets, and using data to assess and manage progress toward those goals. Specifically chosen KPIs depend on the investment strategy, but good impact indicators tend to have a few characteristics in common: They are relevant to the core business of the issuer or investee. This ensures that impact measurement will yield useful information to managing investments, and it also increases the likelihood that data will be available.

2. Make impact measurable

Indicators should provide meaningful insight into the various dimensions of impact such as the key benefit, who benefits, to what extent and for how long. Multiple metrics may be required to achieve this; however, aligning metric definitions with industry standards reduces reporting loads and enables comparability across investments and portfolios. A number of metrics and indicators’ databases to measure impact exist. They provide standardized definitions of outputs and outcomes for investors and companies to use, divided by sector and sub-sector.

3. Push the limits of frameworks

If a reasonable framework or standard exists, leverage it, and improve it, don’t seek to replace it. Yet, there might not be one single methodology or framework that fits all purposes. Investors may require different information depending on their impact strategy, while the underlying assets (the companies that need to measure and provide data) have different levels of capacity and budget to perform assessments. In addition, the lack of data and data infrastructure in a country or sector hinders the use of complex modelling techniques and monetization methodologies. Hence, a solid set of frameworks can be adapted and used in different contexts to facilitate benchmarking and transparency.

4. Harmonize your data

Each platform excels at some aspects of impact reporting yet does not do as well in others. As an example, some platforms focus on ESG reporting (disclosing efforts to mitigate negative impacts) for public equities, while others focus on positive impact reporting for private investments. It is tempting for both types of platforms to focus on strengthening areas of weakness. Building a broader foundation with data harmonization and interoperability, however, offers a path to not only advanced technology but also to a new level of insights.

5. Make it accessible

Moving to the cloud is a fundamental step to capture and store internal and external data, both structured and unstructured. Data interchange is essential so that at least some of the core data housed in one platform is accessible to other platforms. Otherwise, the work required to generate a consolidated impact report will remain too great a barrier — and investors will have to keep guessing about the relative social and environmental impacts of their investments, rather than act on facts and actual impact performance. That is why it is crucial to identify strong KPIs as well as having third-party entities confirming that intentions have been converted into actions. This is helpful to demonstrate how investors implement principles and guidance into practice.

"The battle against climate change isn’t a choice, it’s billions of choices."

Punit Renjen, Deloitte Global CEO

"The battle against climate change isn’t a choice, it’s billions of choices. No action is insignificant, but certain activities and decisions ‘move the needle’ more than others, and those bolder actions from business leaders are needed now,” says Punit Renjen, Deloitte

Global CEO.The transformational achievement of our time will be to reach sustainability in both senses of the word – meeting environmental requirements while maintaining and building resilient businesses. This endeavor will only succeed if we consider and manage buildings not as static entities but as information ecosystems whose value hinges on data.