What is GRESB reporting and why should you do it? - Part I

The clock is ticking. As urgency rises to meet the United Nations Sustainable Development Goals (SDGs) by 2030 and achieve Net Zero carbon emissions by 2050, there has never been a more crucial time for the real estate industry to enforce environmental, social, and governance (ESG) compliance.With the building and construction industry accounting for roughly 40% of global carbon emissions, our efforts are paramount to tackling the climate crisis. The tricky question is – how can building managers effectively assess the sustainability of a real estate portfolio, predict its impact on the environment, and implement active changes toward a more positive outcome?Sustainability can only be improved when it’s measured. That’s where green building evaluation systems in ESG reporting come into play, such as the GRESB (formerly known as Global Real Estate Sustainability Benchmark).

"GRESB assessments show that comprehensive asset-level data, facilitated through data platforms, is vital to set, report and achieve net zero targets."

Steven Pringle

GRESB Director of Members Relations

What is GRESB?

Launched in 2009 in the Netherlands, GRESB is one of the several organizations issuing standards for ESG performance disclosure. By providing validated ESG performance data and peer benchmarks, GRESB reporting helps real estate investors and managers assess the sustainability performance of ESG commercial real estate on a global scale, in a standardized and objective way.

Why do you need GRESB?

GRESB results provide a practical way to understand ESG performance and communicate it to investors and other stakeholders. On top of supporting you in reaching sustainability goals, implementing GRESB reporting can lead to other viable benefits for achieving a higher score and ultimately having a future-proof portfolio. The information you receive at the end of your GRESB evaluation process can be used to:

Meet environmental targets:

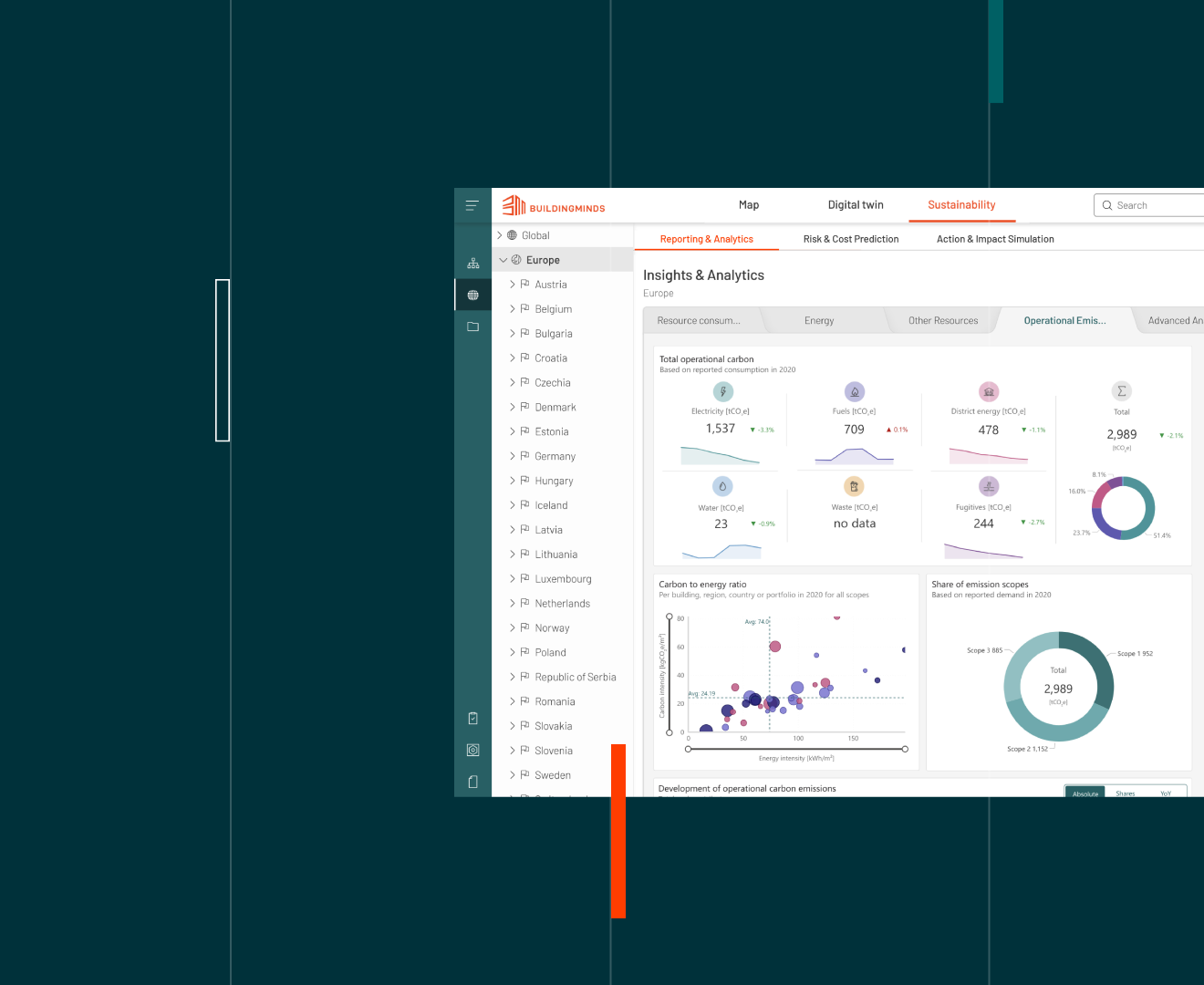

By feeding your ESG data into a data platform like BuildingMinds you can understand your operational carbon emissions. This allows you to calculate the transition risk of your portfolio, in order to plan advanced retrofit predictions and run an impact simulation. You can then decide which retrofits will have maximum return on reducing energy to carbon intensity. All these efforts help to increase property value. Meanwhile, companies that are not yet ESG-compliant are under pressure and scrutiny by regulatory bodies. In this case, GRESB provides the ideal framework approach to catch up and get a handle on decarbonisation.

Increase capital and real estate investment opportunities:

Private and public investors use GRESB as the barometer of your sustainability performance. So if your company meets the high criteria of GRESB evaluation, the data you collected becomes a valuable asset. In fact, both tenants and investors are willing to pay more for green buildings. Conversely, a lack of evidence in planning can have a negative impact – leading to valuation discounts of 10% to 30% for building owners who lack a credible decarbonization forecast in their financial statements.

Boost profits and business value:

Gathering ESG data points in your GRESB report and disclosing them can tangibly affect your company’s corporate performance. It helps you meet stakeholder demands, manage your business effectively, and have superior access to capital. That’s why it’s becoming standard practice for businesses, with 86% of the S&P 500 participating in voluntary ESG disclosure.

Ultimately, access to this benchmarked data enables all players in the industry to make more informed business decisions that help mitigate ESG risks, find improvement areas and enhance long-term returns on their investments or portfolio.By elevating the transparency and standardization of ESG reporting across the industry, GRESB reporting appeases businesses, investors and regulators, alike. By improving your business intelligence and industry engagement, GRESB can also have a significant impact on your bottom line.

How GRESB reporting works

Every year in April, GRESB issues a survey to collect feedback from property companies. If you’re a property company or fund participating in GRESB, you’ll have a three-month window between April 1 to June 30 to respond and gather data.The GRESB Real Estate Assessment is split into three components: Performance, Management and Development. The Management Component measures information collected at the entity level like strategy and leadership management, policies and processes, risk management, stakeholder engagement approach, and so on; while the Performance Component is made up of information collected at the asset portfolio level and measures asset portfolio performance.Each component is broken down into “Aspects'' covering a specific topic, for example, diversity & inclusion policies. Within each aspect, there are questions – multiple-choice, fill-in-the-blank, and essays – used as material indicators, such as Energy, GHG, Water, Waste and Building Certifications. How well you answer determines your score, which is assigned as a percentage out of 100 – with the Performance Component totalling 70% of the overall score.That's why it's absolutely essential to provide detailed, up-to-date data points around qualitative and quantitative performance. Additionally, you’ll have to include information about management and business practices. Accuracy and honesty are key, as all your answers go through an extensive examination process, including GRESB scoring, rating and data validation. The scoring is done using an automated technology platform.Results are released in September. Participants then receive a scorecard with a summary of overall performance, as well as a GRESB Benchmark Report containing a more in-depth analysis of how they are outperforming or underperforming other entities globally.

How to submit a GRESB report

Given the significant impact of GRESB reporting on any organization, sustainability and property managers may understandably feel under immense pressure to deliver an outstanding GRESB report.However, the short time frame for the GRESB survey submission and the complexity of the data collection process can feel incredibly overwhelming. How can you solve this challenge and where to begin when submitting your GRESB report?In part two of this article, we’ll share how you can improve and simplify the GRESB reporting process and improve results. Click here to continue reading.