Why ESG Data Is Set To Become The Most Valuable Business Asset

By Dr. Michael Soucek, VP of Data at BuildingMinds

In the world of commercial real estate investment, the profitability of a portfolio isn’t limited to brick-and-mortar market value, location or market conditions. A building’s energy efficiency is becoming a key part of acquisition and divestiture due diligence: if a building has a big carbon footprint, it could cost you. With regulatory pressures mounting, non-compliance could soon be a major factor in overhead costs, along with higher operating costs and lower occupancy rates.

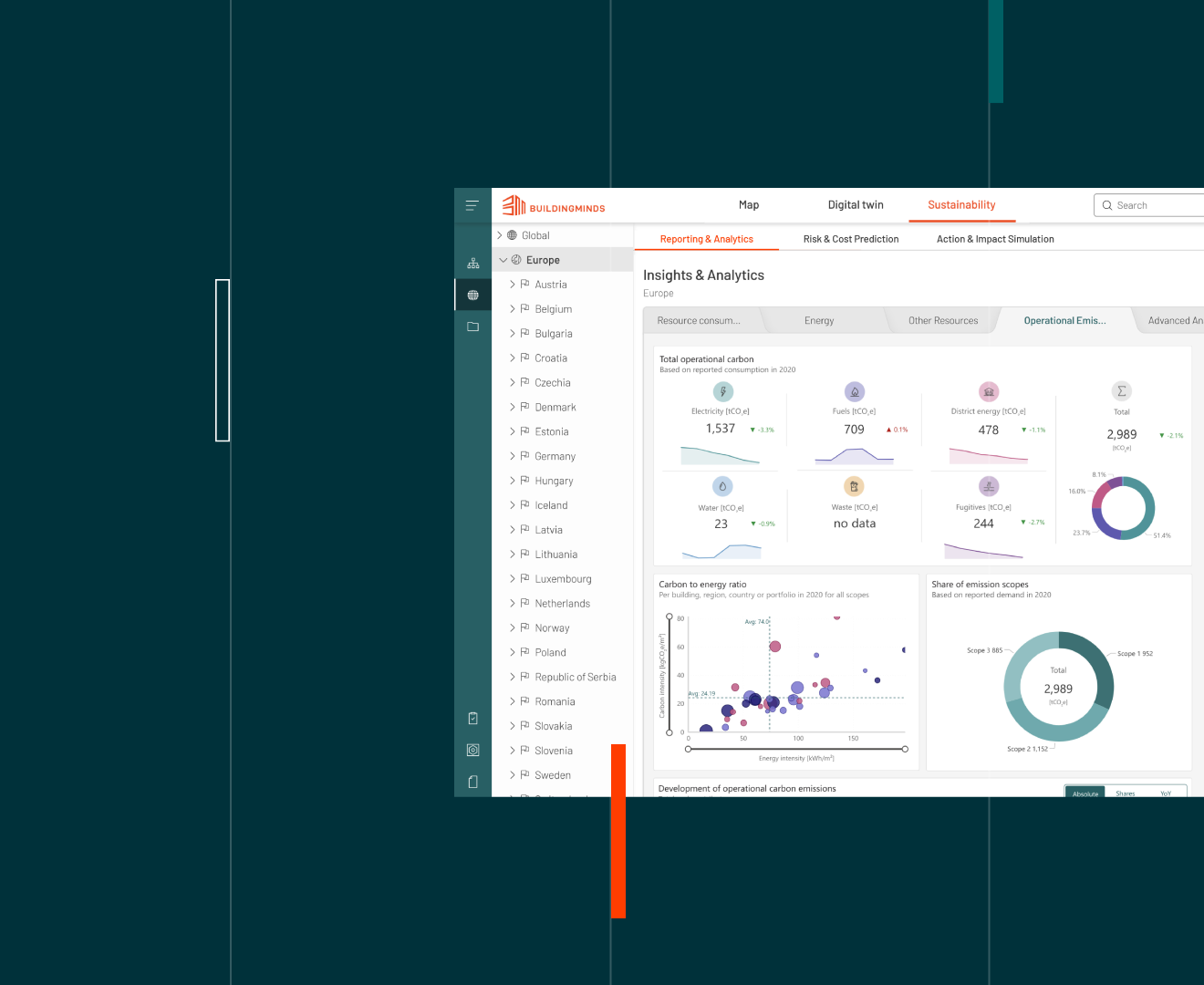

Technology is helping to improve the energy efficiency of assets and portfolios. By leveraging data analytics, firms can mitigate risks, uncover opportunities, and make informed decisions that safeguard their commercial real estate investments. Determining where and how to allocate CapEx today to drive down OpEx tomorrow is the best way to boost an asset’s value.

Preserving Asset Valuation: Sustainable Investment and Value Preservation

It’s well known that commercial real estate investments require capital to maintain and carry inherent risks. In addition, asset owners have an obligation to investors and tenants to ensure a proven plan is in place to boost a building’s climate resilience. Companies conducting due diligence on potential acquisitions or divestitures must assess various factors, including asset’s physical risks, stranding risks, and market dynamics. These assessments require a deep understanding of the local rental market, interest rates, and development trends.

Having a robust data strategy can help key stakeholders analyse these variables effectively, identifying potential challenges and opportunities early in the decision-making process. The ability to collect and analyse data can also help companies to navigate market volatility, and understand risks and market dynamics - which, especially in sectors like office or retail, pose significant challenges for investors.

Fluctuating rental markets and uncertain economic conditions can impact cash flow projections and asset values. A data-driven approach equips companies with the insights they need to navigate these challenges proactively. By monitoring market trends and analysing historical data, investors can adapt their strategies to mitigate risks and capitalise on emerging opportunities.

How Data Can Help Maximise Property Value and Operational Efficiency

At the core of every commercial real estate investment strategy is the goal of maximising property value and operational efficiency. Current data-driven approaches focus on maximising both property value and operational efficiency simultaneously, including indication on how to optimise asset performance, identify cost-saving opportunities, and enhance operational cash flow. By analysing variables such as occupancy rates and maintenance records, investors can make data-driven decisions that drive long-term value creation.

For investors and property managers, fulfilling fiduciary obligations is also paramount. Managing risk, maximising property value, and ensuring regulatory compliance are essential components of this responsibility. Having a solid data strategy empowers stakeholders to meet these obligations effectively. By leveraging data analytics, companies can streamline operations, enhance risk management practices, and deliver superior returns for investors.

Protecting Valuations Against Regulatory and Reputation Risks

In today's regulatory landscape, transparency and accountability are paramount. Companies risk reputational damage and regulatory scrutiny if they are perceived as greenwashing or misrepresenting their sustainability efforts. However, real estate owners and managers need to think beyond compliance: in today’s sustainability-driven business landscape, reaching compliance is only the tip of the iceberg.

Companies also need to consider how sustainability initiatives can safeguard and preserve their asset values. If a building is not performing well from a sustainability perspective, it will ultimately bring down portfolio value and could make it more complex for those companies looking for further investment.

A solid data strategy is needed to accurately report on ESG performance, demonstrating a commitment to transparency and responsible investing. By providing stakeholders with reliable data and insights, companies can build trust, attract investors, and protect their brand reputation.

However, it’s also worth noting that data needs to be consumable in order to be useful. You can have thousands of KPIs, but what matters at the end of the day is reporting on the few that make or break compliance and actually demonstrate improvements in energy efficiency.

Data Will Be Key to Unlocking New Opportunities for Real Estate Investment Growth

While the practice of integrating sustainability and efficiency factors into traditional financial models has not yet been widely or universally applied in the real estate sector, companies do understand that they need to start using data to ensure they make sustainable investments. Overcoming these challenges is going to require industry collaboration, regulatory support from governments, and ongoing innovation in measurement and reporting practices.

In an increasingly complex and competitive commercial real estate landscape, a top-notch data strategy is indispensable. By harnessing the power of data analytics, companies can navigate market uncertainties, mitigate risks, and unlock new opportunities for growth. Whether it's assessing property values, optimising operational efficiency, or enhancing ESG reporting, a data-driven approach is essential for safeguarding commercial real estate investments in today's dynamic environment.