Our solutions

Take advantage of a truly holistic real estate management solution that covers all your business needs – including ESG reporting, carbon risk calculation, retrofit planning, portfolio performance, space management, building experience and more.

A platform that puts you in full control of your data

Reporting and ESG

Real estate managers are often drowning in data. BuildingMinds helps you navigate the complexities, storing all your data in a single place so you can access the right data, of the right quality, at the right time. Our state-of-the-art platform also makes it easy to reuse the same data for multiple ESG reporting standards, such as GRESB, SFDR and ISSB.

- Resource consumption & emissions analytics

- ESG reporting

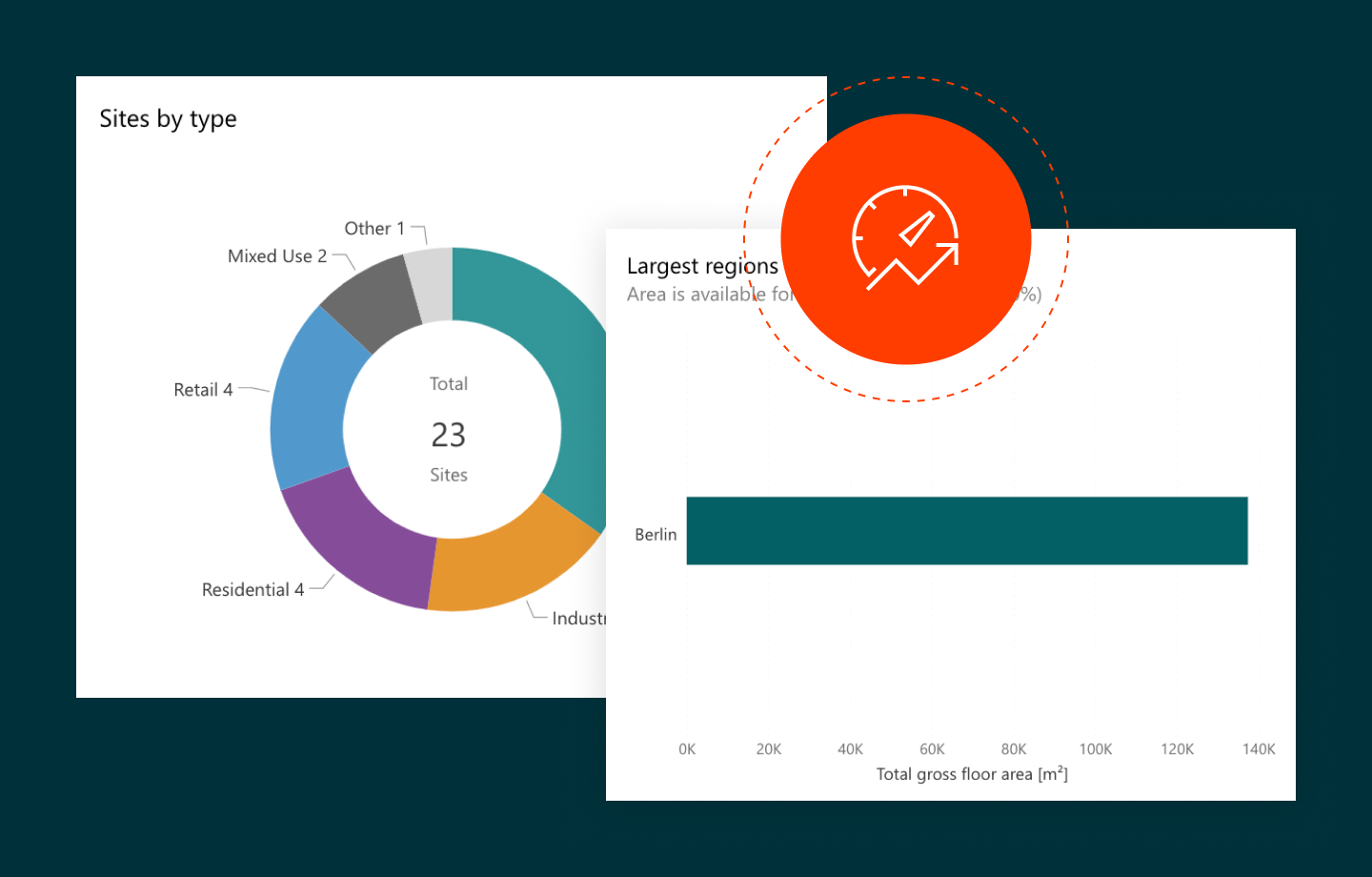

Portfolio management

Ready to make more reliable, data-driven decisions on your journey to net zero? Analyze your emissions, what they will cost you and what you need to change in the coming years to turbocharge the performance of your assets.

- Carbon risk & cost prediction

- Retrofit planning & impact simulation

- Portfolio performance management

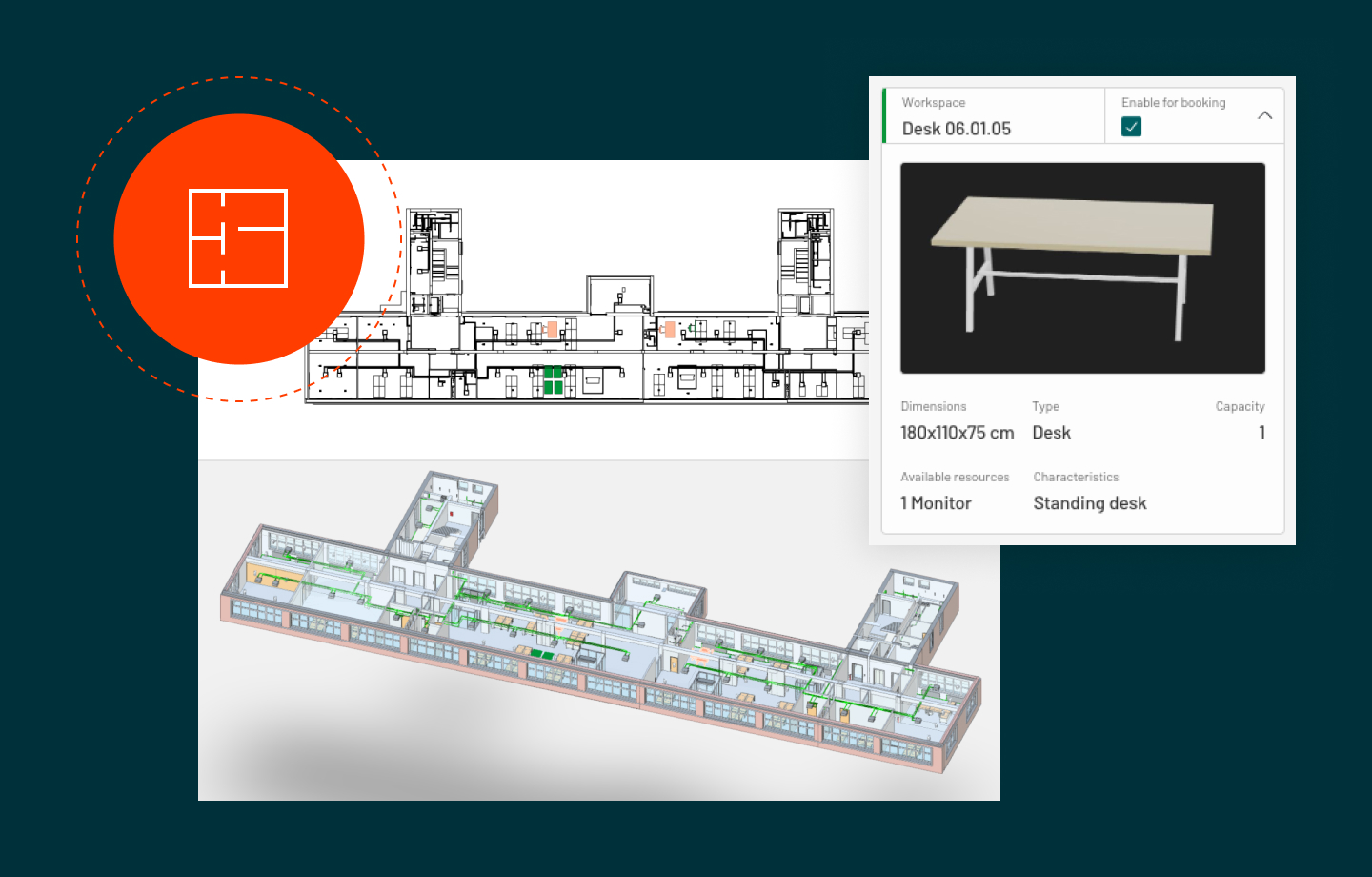

Digital building twin

Managing corporate real estate assets can be challenging. Our solutions help you plan and run your assets on a day-to-day basis, monitoring usage and identifying any potential cost improvements.

- Equipment management