How to simplify and improve GRESB reporting - Part II

In the first part of this article, we explained the why, how and what of GRESB. What next?In part two, we’ll look at how you can efficiently tackle the challenges of GRESB reporting and streamline the data-collection process – ultimately, helping your commercial real estate business improve its GRESB score and meet sustainability goals.

The challenge with GRESB reporting

Given the relatively short time frame for the GRESB survey submission, data collection poses an enormous challenge for sustainability and property managers. Gathering all the information required to populate an ESG sustainability report – be it GRESB or ECORE – is a Herculean task, let alone if done manually. Given its sheer complexity, it can be an incredibly time-consuming and confusing process.Firstly, the data provided must be as close to real-time as possible – otherwise, by the time the survey is completed, the results are already obsolete. Moreover, GRESB reporting requires continuous access to data points which are based on a huge number of dynamic variables, such as consumption data like waste and carbon output.

How to improve the data collection process

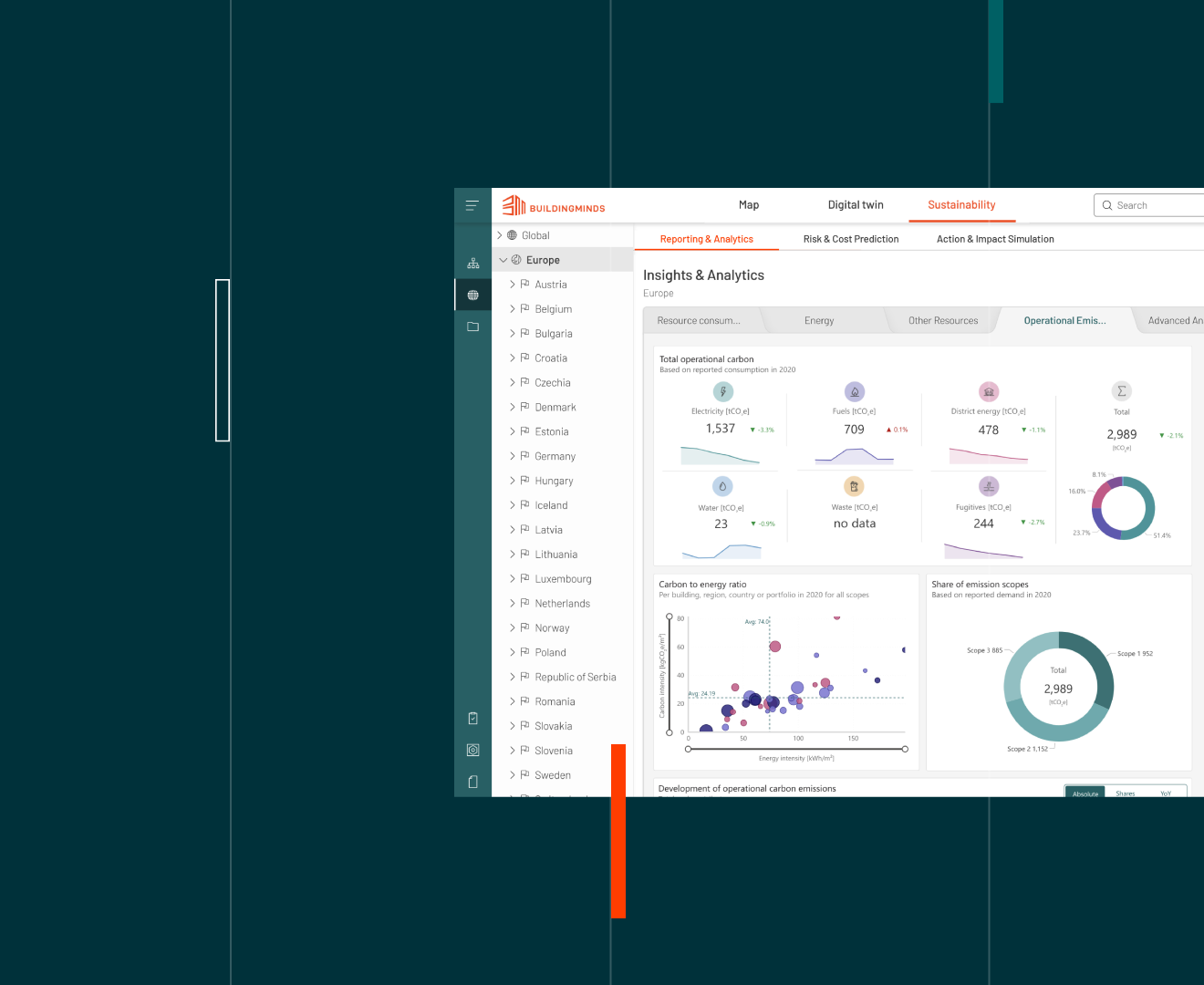

The silver lining is that digital technology can help enormously in solving the biggest pain point which is data collection. Incorporating an automated and integrated ESG analysis and reporting data platform like BuildingMinds minimizes the risk involved in complex analyses with countless variables and constraints.BuildingMinds is seamlessly integrated with GRESB and the GRESB portal, which immensely simplifies the ESG reporting process, from data collection and maintenance to evaluation. So, once you have set up a database, our platform operates automatically. As a GRESB Premier Partner, you can use a variety of tools to optimize and streamline your GRESB Real Estate Assessment submission. These include:

Automatic transfer of all available asset-level performance data to the GRESB portal. Dynamic data is fed directly into the system and added to the database via an API. You can then access reporting data statements and daily insights in near real-time.

GRESB’s set of 412 validation rules is implemented, allowing for continuous data validation and streamlined data collection. The system immediately checks all available data points for errors, so that users can rectify them ahead of submission..

GRESB performance KPIs and its data framework are deeply integrated into the ESG Management Solution, enabling multi-year and multi-purpose analysis.

BuildingMinds’ Data Survey App enables simplified data collection via simple forms. The data is then transferred from the app to the platform directly via APIs. This facilitates the collection of information from multi-stakeholders and helps in providing missing consumption value.

By managing and improving your end-to-end GRESB survey experience, our real estate data platform puts an end to time-consuming data gathering and fault-prone consolidation processes, allowing your company to save time and cut costs. Ultimately, your enhanced data quality leads to an improved GRESB score.

Above and beyond sustainability

The time for effective change is now. GRESB reporting provides a framework, while digital technology gives us the ESG reporting tools to set, report and achieve net zero targets. The question is no longer when, but how.By adopting a data platform into their business, real estate companies can dynamically adapt sustainability strategies, initiate immediate responses to anomalies, and align day-to-day business operations with their sustainability targets – all at the push of a button.

But BuildingMinds delivers a plus beyond ESG reporting by enabling other multiple use cases. Users can set up calculated action plans for carbon risk reduction and portfolio value preservation using the Carbon Risk Real Estate Monitor (CRREM) evaluation methodology as a framework.. They can also access advanced retrofit scenario analytics to identify the investments and actions with the best impact on asset, fund or portfolio level.

Leveraging a purpose-built data ecosystem can empower you to reap benefits far beyond sustainability. Its effects will be felt deeply on all levels of your real estate organization, and on a collective level, for years to come.

"As a premier partner of GRESB, we take pride in helping our real estate clients not only meet GRESB standards – but also, exceed them. This shows their dedication to building a more sustainable future, from which everyone will benefit."

Marek Sacha

CEO BuildingMinds