BuildingMinds and GOLDBECK Sustainability Consulting partner to provide ESG data-led growth for HANSAINVEST

The new joint offering supports real estate, asset, and portfolio managers in the analysis of ESG data on the journey to net-zero buildings

The project partnership supports capital management company HANSAINVEST to optimize its ESG compliance data and protect the future value of almost 1,000 residential, office, and commercial property portfolios

The new ESG-reporting technology and expert consultancy offering aims to increase the value of real estate portfolios in light of stricter ESG regulation

Berlin, Germany: 18 March, 2024: BuildingMinds, the leading ESG data management platform for the real estate value chain, today announces its new project partnership with GOLDBECK Sustainability Consulting to provide ESG data-led growth for the real estate value chain.

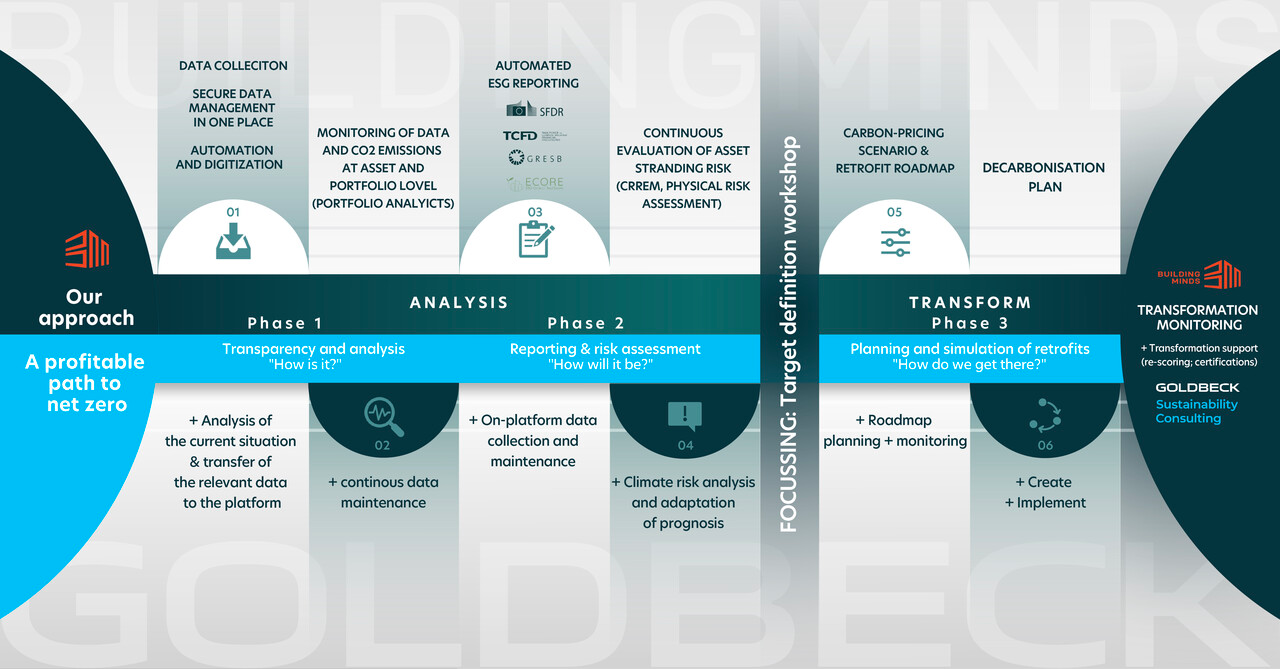

The new joint offering for HANSAINVEST is designed to support real estate, asset, and portfolio managers with ESG data-led insights and expert consulting services to help companies build more resilient, ESG-compliant real estate portfolios. Using BuildingMinds’ comprehensive data platform and GOLDBECK’s consulting expertise, customers are supported as they collect ESG compliance data. The combined solution and services are helping companies to implement economical, scalable measures that ensure the ESG compliance of their real estate portfolios, to balance risk management while securing their future value.

The current project partnership between the two companies has been met with a positive response and is now supporting a large sustainability-focused real estate development project for capital management company HANSAINVEST. HANSAINVEST is working with GOLDBECK to conduct a CRREM analysis (Carbon Risk Real Estate Monitor) for over 1,000 of its real estate assets. GOLDBECK will determine the financial risk based on a building's energy consumption, revealing which real estate assets may be exposed to standing risk.

BuildingMinds’ technology is being applied to intelligently process this data to assess and provide highly strategic cost-efficient recommendations, including average CapEx per year and CapEx to tons of Carbon equivalent (tCO2e). HANSAINVEST will receive risk reports at portfolio, fund, fund partner and asset class level and the assurance of meeting compliance in line with all new regulatory policy, including the CO2 Taxonomy and SFDR.

In the second step of the project, GOLDBECK and BuildingMinds will work to plan the strategic transformation process for the decarbonization of portfolios and individual assets for HANSAINVEST. Capabilities within the BuildingMinds’ platform will enable precise planning against frameworks such as those outlined by the Paris Agreement.