Data Intelligence: A Game Changer for Italy's Real Estate Market

According to the Real estate Data hub report, a major growth in sustainability investments is expected in Italy in 2024, a symptom of companies and consulting firms becoming aware of the importance of data in positioning real estate assets on the market and consequently into more business opportunities.

In this context, BuildingMinds, a company of the Swiss Schindler group - operating in the elevator and escalator sector - lands in the Italian market. With its ESG data intelligence platform, it collaborates with stakeholders throughout the real estate ecosystem to collect data and provide owners and managers with tools to process them through various modelling ing methods - including carbon pricing scenarios and retrofit interventions - ultimately returning useful insights and, above all, actionable measures.

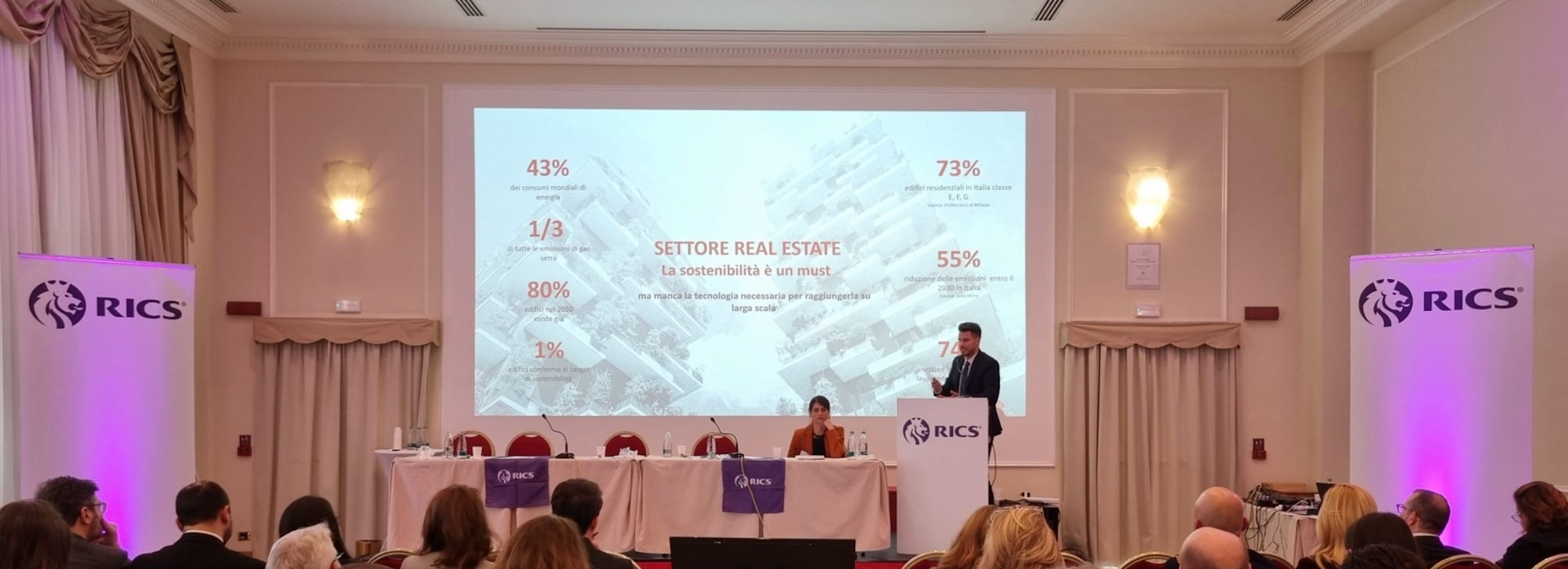

"The Real Estate sector in Italy has been investing heavily in ESG in recent years, and this is no coincidence. Our country has an obsolete building stock, consisting, for example, in the residential segment of about 73 percent of properties in the lowest energy classes (E-F-G). This contributes to a sector that at the European level is responsible for at least 40% of energy consumption and ⅓ of total CO2 emissions.

Achieving the goals of the European Green Deal - to reduce greenhouse gas emissions by 55 percent compared to 1990 by 2030 and to achieve net zero emissions by 2050 - requires strategic planning to retrofit buildings to improve their energy performance while increasing their commercial value. After France, Spain, the UK and the US, BuildingMinds enters the Italian market at a crucial time for the sustainable transition of businesses and individuals with a new technology that can concretely support owners and managers by returning data on efficiency, financial benefits and risk management strategies based on insights from our tools", said Andrea Tassello, country manager for Italy at BuildingMinds.

Founded in 2019 in Berlin as a startup and led by CEO Marek Sacha, BuildingMinds represents the Schindler Group's desire to diversify its services with a focus on sustainability as the added value of its offerings.

The company is aimed at owners and managers of large estates and real estate funds, able to guide major interventions in the life cycle of buildings such as, for example, major renovation projects or the adoption of energy-efficient installations. The focus is also on a new target audience: in fact, BuildingMinds is working on the development of an insight app for residents to help them foster day-to-day operational efficiency in their spaces.

With 141 employees located in Europe and active partnerships in several countries, today BuildingMinds supports real estate professionals along the entire value chain, providing useful insights for drafting reports, risk and profitability assessments, thus, carbon risk, stranding risk, CapEX, and cost simulation, without neglecting the interdependencies related to portfolio management.

As a rule, such complex analyses oblige building owners and managers to use numerous consultants to study retrofit actions and budgets to invest, which often leads to onerous costs if not supported by appropriate technology. For this reason, BuildingMinds has developed the "Retrofit Recommender," a new tool that, through Artificial Intelligence and Machine Learning, allows to identify in real time the most effective retrofit actions to be carried out on buildings, providing an estimate of spending budgets thanks to the analysis of consumption and emissions, along with a pre- and post-renovation budget. In particular, Retrofit Recommender is designed to have a clear link to KPIs such as net operating income (NOI), value at risk (VAR) and asset value revaluation, allowing, for example, companies such as Zurich to create a Rex-Fund capable of attracting new investors and capital thanks to a previous Top-Down analysis - retrofit actions and CapEx of individual buildings - and a Bottom-Up one, thus, the study of interventions to significantly achieve decarbonization targets at the portfolio level, carried out with the support of the platform.

Click here to check the full article!