BuildingMinds Publishes GRESB Paper on Driving Sustainability Performance Through Asset-Level Data

[London, 10 July 2024] - BuildingMinds, a leading real estate software-as-a-service (SaaS) provider, today published a whitepaper written by GRESB, the global sustainability benchmark for real assets, looking at how asset-level data can drive sustainability performance and investment decisions in the real estate sector.

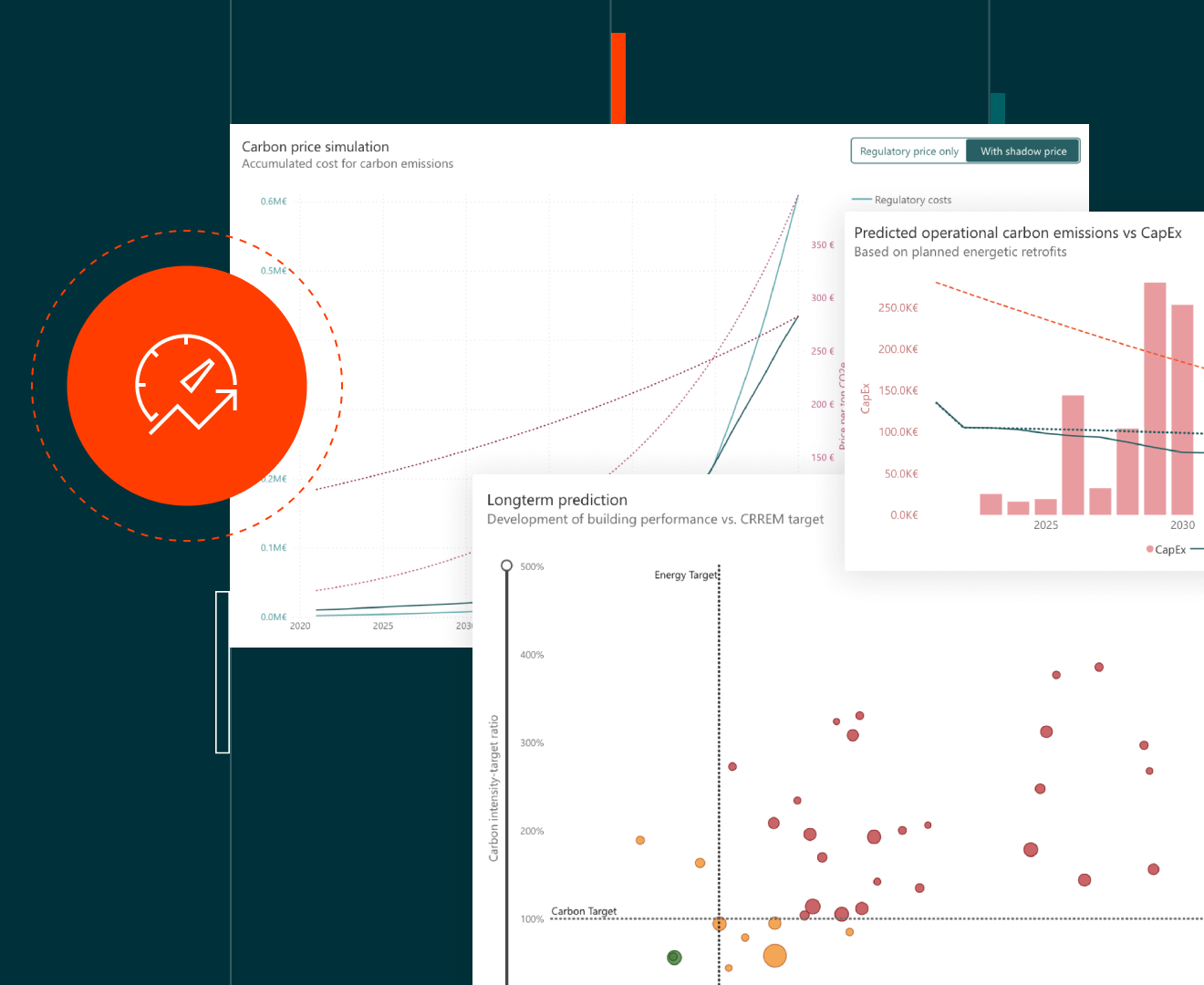

The collaboration between BuildingMinds and GRESB aims to help the sector understand how asset-based data can be used to inform sustainability initiatives and investment decisions by emphasising the significance of this data in decarbonisation, due diligence, and asset optimisation. The paper will help real estate investors and managers to effectively evaluate ESG initiatives by complementing portfolio-level views with granular, asset- level performance data.

Marek Sacha, CEO of BuildingMinds, shared his thoughts on the wider partnership between the two organisations and the importance of data and benchmarking in driving sustainability performance. "Data is the foundation for informed decision-making and effective benchmarking in the real estate sector. GRESB leads the way in providing standardised and validated ESG data for real assets, which is crucial for driving sustainable practices across the industry. Our partnership with GRESB is about highlighting and sharing expertise on innovative solutions that help real estate investors and managers optimise their assets and accelerate their sustainability efforts."

Sebastien Roussotte, CEO of GRESB, also expressed his enthusiasm for the collaboration and highlighted the significance of targeting a shift towards asset-level prioritisation: "Fund managers looking for comprehensive insights into their real estate portfolios understand the critical role asset-level performance data and benchmarks play in driving decision-making. We are pleased to collaborate with BuildingsMinds to share perspectives on how managers can approach their portfolios to optimise individual assets and drive positive outcomes, both financially and environmentally."

Key findings from GRESB's whitepaper:

Aggregated portfolio data is not sufficient for meaningful portfolio decarbonisation. Since portfolios are decarbonised by action on individual assets, it is crucial to base planning decisions on data collected from individual assets.

The choice of interventions, along with the assets within a portfolio to which they are

applied, has a significant impact on the achievement of long-term decarbonisation goals.A brown-to-green investment strategy has a much larger impact on reducing energy consumption compared to improving already-green assets. Selecting high- consumption assets from dispersed or diverse portfolios can result in a 10-to-30-fold greater reduction in energy consumption.

As a GRESB partner, BuildingMinds helps clients to take advantage of data-driven insights that empower real estate investors and managers to make informed decisions and accelerate their sustainability efforts.

About GRESB

GRESB is a mission-driven and industry-led organisation providing standardised and validated ESG data to financial markets. Established in 2009, GRESB has become the leading sustainability benchmark and insight provider for real estate and infrastructure investments across the world, used by 150 institutional and financial investors to inform decision-making. The annual GRESB assessments and benchmarks include more than 2,000 real estate portfolios and funds as well as more than 170 infrastructure funds and nearly 700 infrastructure assets, collectively representing USD 8.8 trillion in gross asset value.

About BuildingMinds

BuildingMinds is a real estate software-as-a-service (SaaS) provider that offers a comprehensive, data-driven platform for optimising building performance and sustainability. Through innovative technology and analytics, BuildingMinds enables real estate owners and managers to monitor, analyse, and optimise their assets, supporting the transition to a more sustainable and data-driven real estate industry.

For more information, please contact:

Peter Panayi,

Head of Go-To-Market BuildingMinds, peter.panayi@buildingminds.com +447929108812