BuildingMinds introduces new ESG features

Automatic interface with global climate risk database

BuildingMinds has a strategic partnership with Risk Management Partners, a division of Munich Re. “In terms of sustainability, it is high time for the real estate industry to really get down to business. And sustainability gains can only be achieved when we have comprehensive transparency on the status quo of real estate portfolios, which in turn requires access to a full suite of relevant data, including on climate risks. Unfortunately, many asset owners and managers are still making do with small-scale and isolated solutions that rule out the kind of fast and efficient progress we need to see”, says Tobias Decker, Chief Product Officer of BuildingMinds.

"Real estate is especially exposed to potential physical climate risks given its nature as a static asset."

Christof Reinert

Head of Risk Management Partners at Munich Re

Munich Re’s Location Risk Intelligence software solution combines the risk assessment expertise of one of the world’s leading reinsurers with state-of-the-art technology. Specific risks from natural catastrophes and climate change scenarios can be called up for every location worldwide – from extreme temperatures and heavy rainfall to earthquakes and forest fires. Via an API interface (Application Programming Interface), the risk assessment data will flow directly and automatically into the BuildingMinds platform, where they can be visualized in dashboards and on a map. Users thus will not only gain transparency about the climate risks to their buildings and portfolios, they will also be able to transfer the data directly into reports such as GRESB or for frameworks such as SFDR.

“Real estate is especially exposed to potential physical climate risks given its nature as a static asset. This makes it all the more important for asset owners and managers to be able to assess these risks appropriately. We are pleased to have found a strategic partner in BuildingMinds that provides asset managers with a comprehensive overview of current and future risks – not least through the integration of our Location Risk Intelligence Platform – thereby enhancing strategic decision-making processes”, says Christof Reinert, Head of Risk Management Partners at Munich Re.

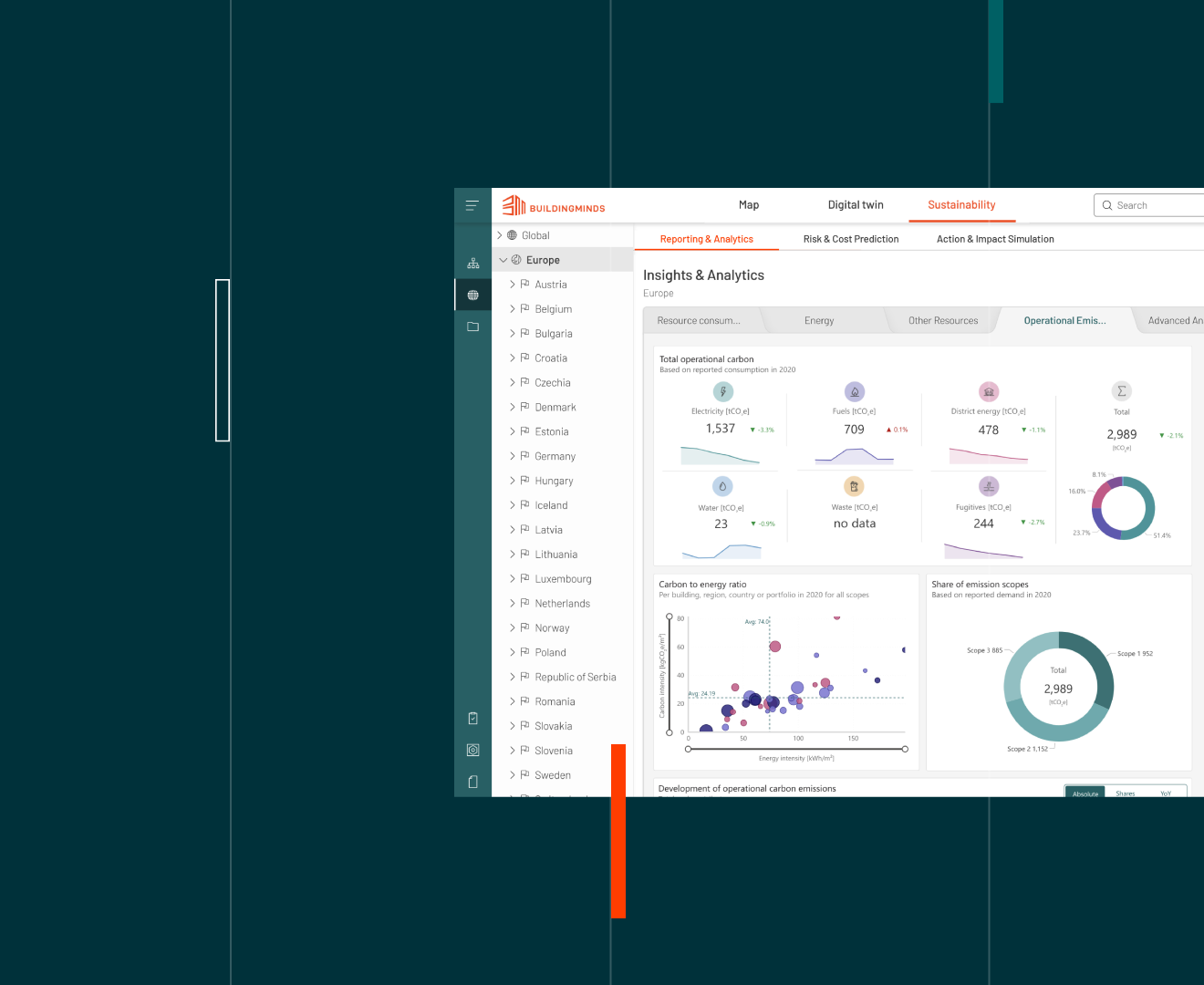

New sustainability features in the ESG Management Solution

Moreover, the BuildingMinds platform provides a suite of innovative new features to support more sustainable real estate and portfolio management. The first of these focuses on data collection. With the help of numerous API connections and the BuildingMinds Data Survey App, all relevant data are collated in the platform. These data are then checked for gaps. On this basis, the BuildingMinds platform not only determines relevant resource consumption KPIs, such energy, water and waste. It also allows to calculate subsequent operational carbon emissions from a single asset to portfolio level and to report on greenhouse gas emissions (GHG Scope 1, 2 and 3).

"Sustainability gains can only be achieved when we have comprehensive transparency on the status quo of real estate portfolios."

Tobias Decker

CPO BuildingMInds

The BuildingMinds platform will also automatically enhance the quality of the collected data and can close existing data gaps, in part by extrapolation. The platform’s ESG reporting features can only be used with a correspondingly sound database, thus efficiently facilitating reporting standards such as GRESB, SFDR or ECORE. In addition, BuildingMinds offers features for CO2 risk management: users can analyze the net present value of carbon cost according to an anticipated regulatory price trajectory - applied to either excess emissions or individual scopes. The platform also enables to set and track the progress toward internal sustainability targets and to simulate the risk of carbon cost against an internal carbon pricing.

The greatest opportunity: retrofitting existing assets

To support energy-efficiency upgrades of the existing building stock, the BuildingMinds platform has a broad suite of retrofit features, the heart of which is the Retrofit Roadmap Overview. This not only bundles all sustainability KPIs in one place, it also displays the potential savings that can be achieved from individual retrofit measures at portfolio and/or individual property level. In conjunction with the platform’s other integrated features, users can create a preview or even simulate a specific retrofit strategy, including capex requirements. Furthermore, a comparison of retrofit strategies enables to determine the most efficient and sustainable transformation of a portfolio or building.

“Retrofitting existing properties presents the greatest opportunity for the sustainable transformation of the real estate sector. This is not only where the most significant untapped savings can be unlocked – it is also where the industry faces its greatest challenge, as asset managers must master the difficult balancing act between conflicting financial, regulatory and environmental goals”, says Decker. “With our retrofit features, which enable data-driven and thus resilient decision-making in this complex environment, we are making an important contribution to helping the industry take advantage of these opportunities”.